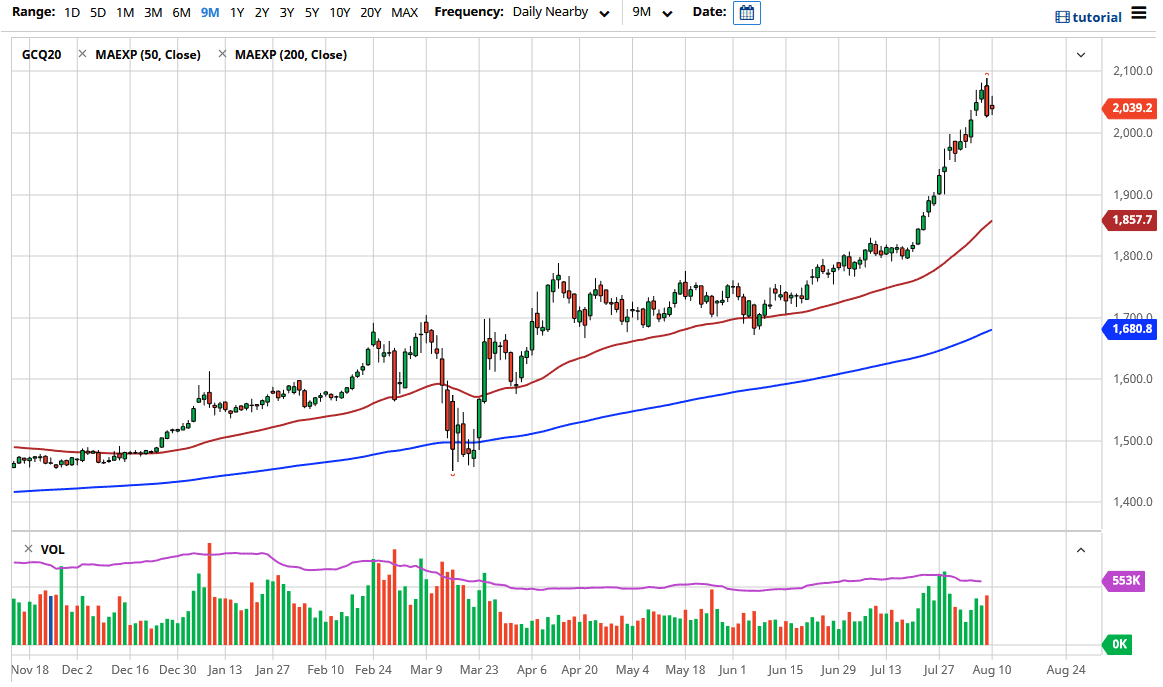

Gold markets gapped higher to kick off the trading session and shot up from there, but we have seen gold rollover since then. With that being the case, we may see a little bit of a pullback which is something that is desperately needed in this market. Gold has been parabolic for quite some time and I think that given enough time we could see a pullback to at least the $2000 level, which would make a certain amount of sense from a psychological standpoint given the fact that we have seen a major breakout from there and it is a large, round, psychologically significant figure. Do not forget how big figures come into play when it comes to these markets, it is something that certainly should not be forgotten.

If we break down below the $2000 level, and I certainly hope we do, I would be more than willing to buy gold somewhere closer to the $1950 level, the scene of a gap that has not quite been filled. I think at that point we would see a lot of value hunters because the Federal Reserve printing greenbacks as fast as they have been the major catalyst for gold going higher and let us be honest here: the Federal Reserve only works to devalue the greenback. In other words, they will not stop. It made the mistake of trying to tighten monetary policy about a year ago and it almost collapsed the financial markets. They are quite literally held hostage by traders.

What this means is that if the Federal Reserve tightens monetary policy it could drive up the value of the US dollar before some type of collapse in the stock market. Guess what? That is good for gold eventually as well. Central banks around the world continue to do the same as the Federal Reserve so it makes sense that gold continues to rally against almost anything and everything it touches. That does not mean that you can jump in and buy right away, just that you need to be looking at pullbacks as an opportunity to pick up gold “on the cheap.” I have no scenario in which I’m willing to short gold right now unless the Federal Reserve somehow changes the entire monetary policy regime, which is not something that is going to be happening anytime soon.