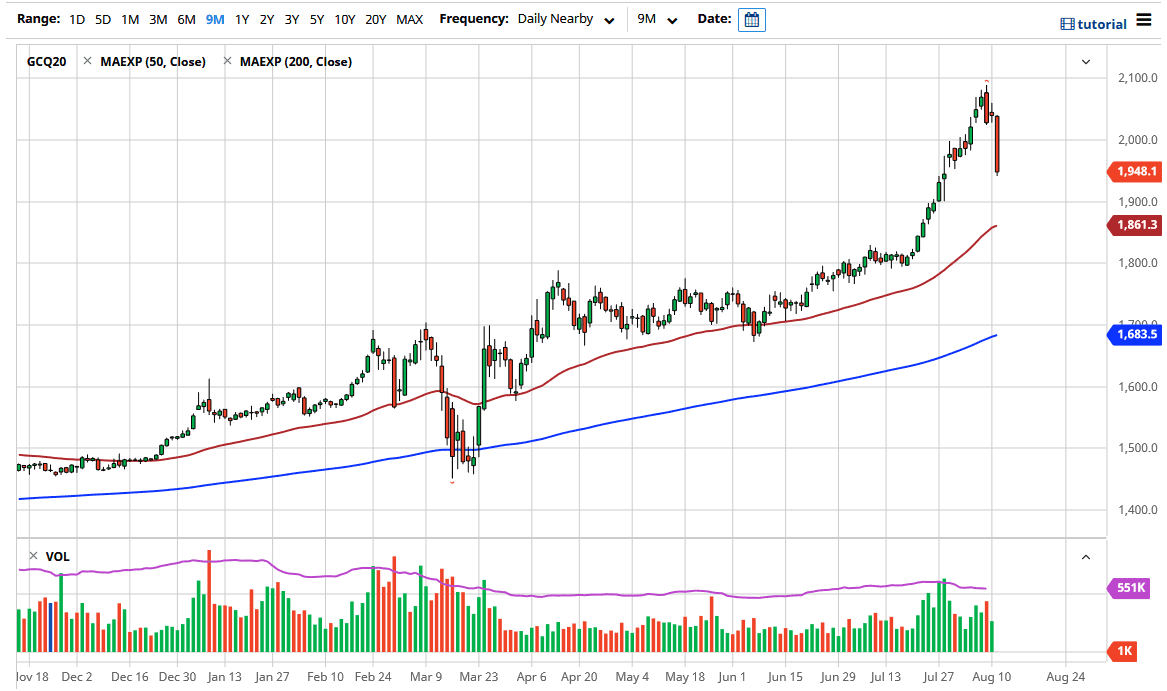

Gold markets have fallen apart during the trading session on Tuesday, as the bullish move in gold has finally been abated. This is a market that had been so overdone that a move like this was likely, although I am the first to admit that I am a bit surprised that it happened in one fell swoop. Looking at this chart, we are well below the $2000 level, and now it looks like we are going to go screaming towards the $1900 level. The 50 day EMA is currently at the $1860 level, an area that should be supportive but I think the $1900 level is likely to be very supportive.

The size of the candlestick is rather impressive, but it does not necessarily mean that the trend is over. I think at this point in time it is simply a matter of waiting enough to be patient and pick up value once the stability returns. After all, this type of move will shake out a lot of the “weak hands” that are out there. This should not be a huge surprise to anyone, retail traders, CNBC, and just about everybody else has been asking about gold and therefore it is not a huge surprise that it eventually toppled over.

As long as the Federal Reserve continues to loosen monetary policy and print greenbacks, gold still has a bright future. However, it has gotten far too ahead of itself, so it is not a huge surprise to see this type of pullback. I am waiting for some type of daily candlestick that shows promise, something along the lines of a hammer or bullish and golfing candlestick. Either way, I have no interest in shorting this market as I think there is more than enough reasons for this market to go higher over the longer term. Looking at the chart, I think I have a couple of days to sit on the sidelines and wait for some type of support to show up. Regardless, this type of volatility has a lot of people nervous, and it makes sense that we would have quite a bit of time to figure things out. Take your time to look for support, be patient, and by all means, do not try to trade this off of short-term charts, this type of washout tends to cause mass chaos for days on a short-term timeframe.