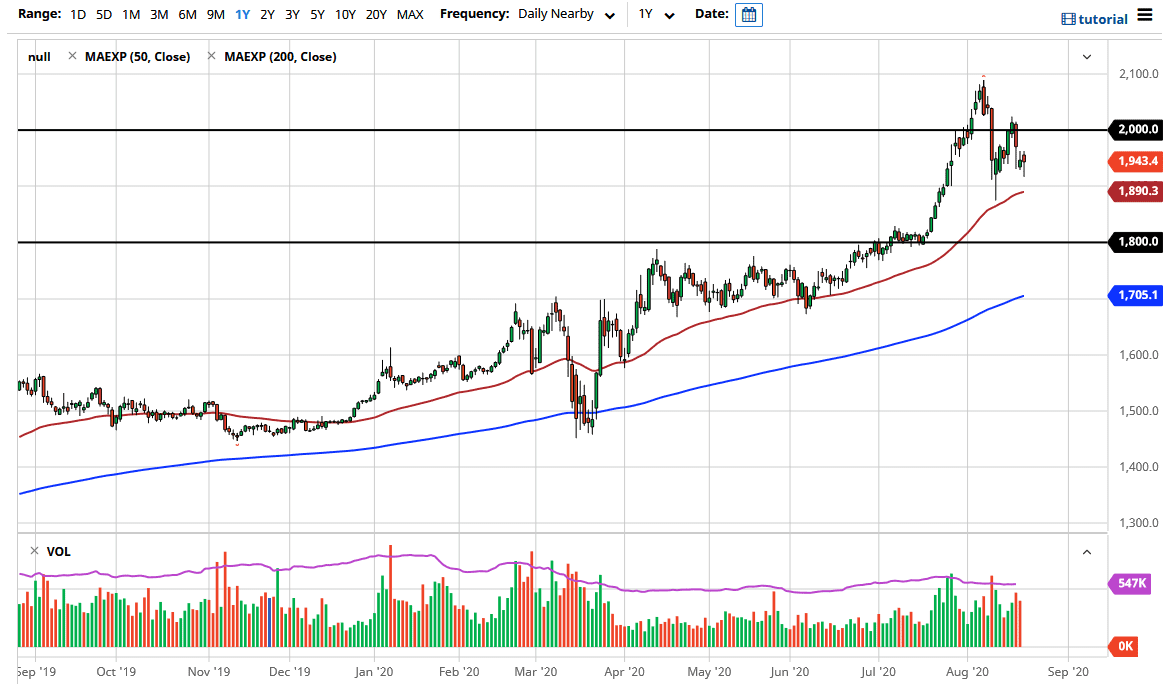

The gold markets gapped higher to kick off the trading session on Friday, but then pulled back a bit to turn around and formed a hammer. The hammer is a bullish candlestick and therefore it is worth paying attention to. The market has been in an uptrend for some time, and now it looks as if we have made a “lower high”, but we have not made a “lower low”. The 50 day EMA sits just below so it is likely that we could find buyers on value, as the gold market has continued to attract a certain amount of attention.

If we did break down below the 50 day EMA, it is likely that the market goes looking towards the $1800 level where I would expect to see even more support. That is an area where we have seen the market break out and shoot much higher, but we have not pulled back towards the area to test it for a “floor in the market”, so that is possible you would find a lot of value hunters in that area. Ultimately, I think that the market does have higher to go but we obviously had gotten parabolic and when markets do get parabolic, it is likely that you will see a lot of choppy action in order to try to stabilize the whole thing. It is because of this that I think you plenty of time to get involved.

If we were to break down below the $1800 level, it is likely that the market could go looking towards the 200 day EMA which is currently near the $1705 level. That is an area that would attract a lot of attention, but I do not think we get there anytime soon. In fact, the fact that we recovered later in the day on Friday does give me a little bit of hope that the gold market will turn around and show signs of strength. After all, even though the US dollar falls, the reality is that gold is being picked up by everybody around the world due to the fact that central banks all over the place are liquefying the markets. If we can break above the $2000 level, we will almost certainly go looking towards the all-time highs again.