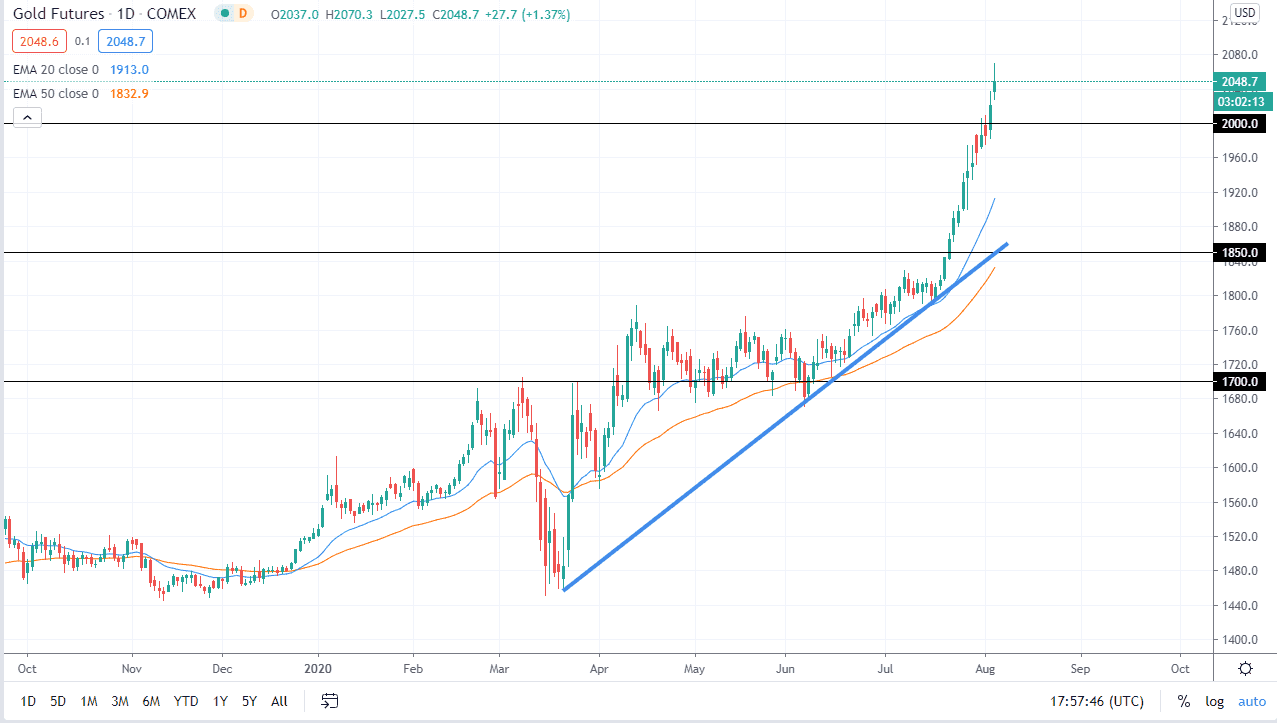

Gold markets shot higher again during the trading session on Tuesday, gapping to the upside right away, pulling back to fill that gap, and then shooting straight up into the air again. However, gold is starting to run out of momentum, so I think a pullback is relatively imminent. After all, it was just about two weeks ago that we were two hundred dollars lower than current pricing. This type of momentum cannot be kept up forever, so I think it makes sense that we need to pull back a bit.

The shape of the candle for the trading session is essentially a shooting star, and that is something that will keep a lot of people paying attention to the gold market. The $2050 level has caused a bit of resistance, and as a result, we have seen quite a bit of selling. I think at this point it is very easy to imagine a scenario where we drop back towards the $2000 level, which is a large, round, psychologically significant figure. I do believe that there will be buyers at the $2000 level, if for no other reason that there will be a lot of “FOMO” out there, and people who had been short from that level that would love to get out at breakeven, or at least something close to it.

If we do break above the top of the candlestick for the trading session on Tuesday, then we would become even more overextended, so at this point, I am not looking to buy gold at these levels. If we do break above the top of the candlestick from the trading session on Tuesday, we will probably go looking towards the 2100 level. However, this is becoming a dangerous game as we have gone straight up in the air, something that does not end well most of the time.

If we break down below the $2000 level, then I will go looking towards the $1950 level, perhaps even lower than that. Regardless, I do like the idea of picking up value as it occurs in have no interest in shorting this market until we break down below the uptrend line that I have on the chart. That would take a significant sell-off, and I believe probably a complete shift in the attitude of the Federal Reserve overall, something that I do not see happening in the short term.