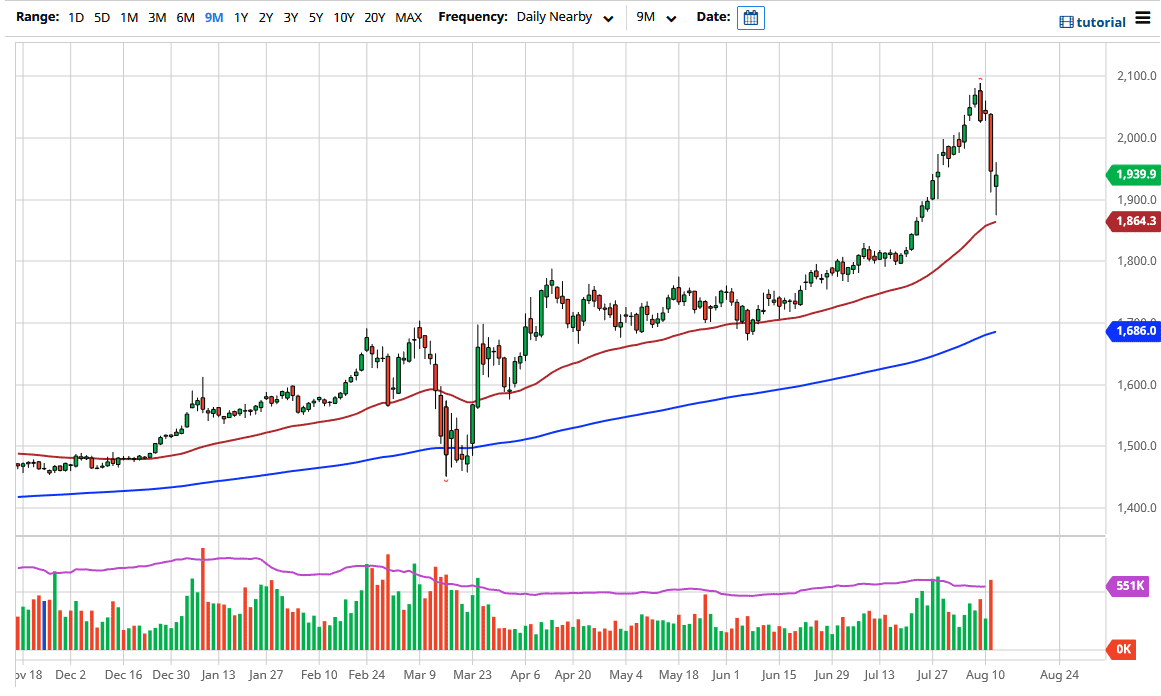

Gold markets finally showed some stability during the trading session on Wednesday, breaking below the $1900 level initially before finding support at the 50 day EMA. By breaking back above the $1900 level, it is likely that we will continue to see buyers in this market kind of look for value on these dips. That does not mean that we will go straight back up in the air, but the candlestick is rather supportive, and it suggests that we are going to recover. Obviously, the $2000 level above will cause a significant amount of resistance, but it is going to be sliced through again.

The Federal Reserve continues to loosen its monetary policy and that works against the value of the US dollar, driving up the value of gold. This correlation is well-known, so a lot of traders will be looking to back the effects of inflation by going long of this market. All that being said, I think that if you are patient and look for short-term dips to start buying gold again, you should be able to build up a larger position.

If we do break down below the 50 day EMA, then we will more than likely test the $1800 level, although I do not think that is as likely of a scenario as breaking to the upside. The $2100 level was where we had seen a lot of selling pressure, and I think it will probably take a bit of effort to get above there. Longer-term though, I do think that happens, but we have a lot of work to overcome the fear. These “FOMO” markets tend to wipe out a lot of retail traders, and I suspect that a lot of people reading this article got absolutely hammered on Tuesday. Hopefully, there is a lesson in that, because when markets go parabolic, they fall quite rapidly. This was the same thing that we have seen in Bitcoin, various currency pairs, and in Silver.

Nonetheless, the US dollar will continue to fall longer-term, based upon what the Federal Reserve is doing. If that is going to be the case, then the precious metals markets will rise, not only just gold, but platinum and silver should follow right along. In fact, commodities, in general, should continue to see a lot of buyers jump in and take advantage of inflation.