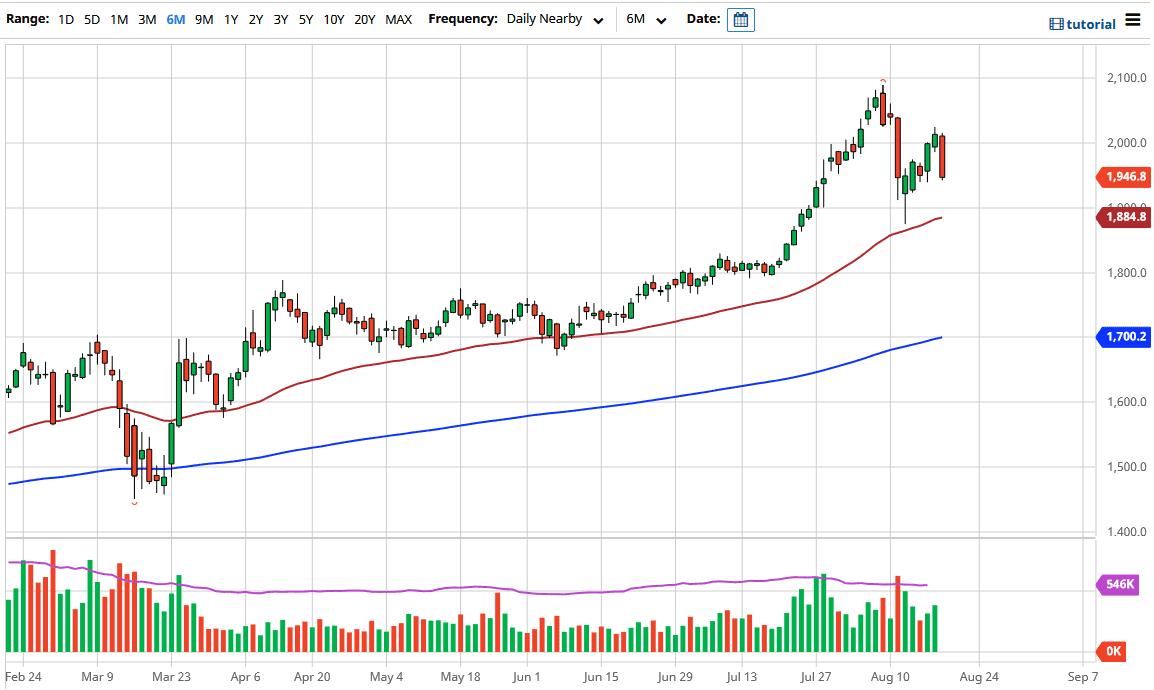

The gold markets have broken down significantly during the trading session on Wednesday, slicing through the $2000 level. We have formed a very negative looking candlestick, and at this point in time, I think we are going to go looking toward support underneath. The 50 day EMA is currently at the $1884 level, which is basically at the bottom of the hammer that showed the market stabilizing enough to perhaps try to take out $2000 again. We failed though, and now it looks like we need to build up a little bit of stability first before we can really put a significant amount of money into the market.

If we break down below the 50 day EMA that opens up the possibility for a market down to the $1800 level, which will be rather supportive. That is an area that has previously been important, both from resistance in a support level, so it is a natural place where buyers will return. That being said, the US dollar has gotten hammered against almost everything out there recently, and it is oversold. Now that it is oversold, the strengthening greenback will probably work against precious metals, at least in the short term.

The question now is whether or not there is a “higher low” that we have just formed. Because of this, I would urge a bit of caution and I recognize that as we head towards the end of the week, we will probably see a little bit more truth enter the market. I think it is only a matter of time before we get some type of impulsive candlestick, but I am more than willing to acknowledge the fact that the three biggest candles lately have been read as far as the larger body size is concerned. We need to pay quite a bit of attention and see what happens with the 50 day EMA and the $1800 level. The market had been a bit too hot recently, so this pullback so far is healthy, but I have to admit the candlestick for the session on Wednesday has made the situation much more precarious than I would prefer. Ultimately, this is all about the US dollar so pay attention to what is going on with the currency, that way you can figure out what is going on with gold.