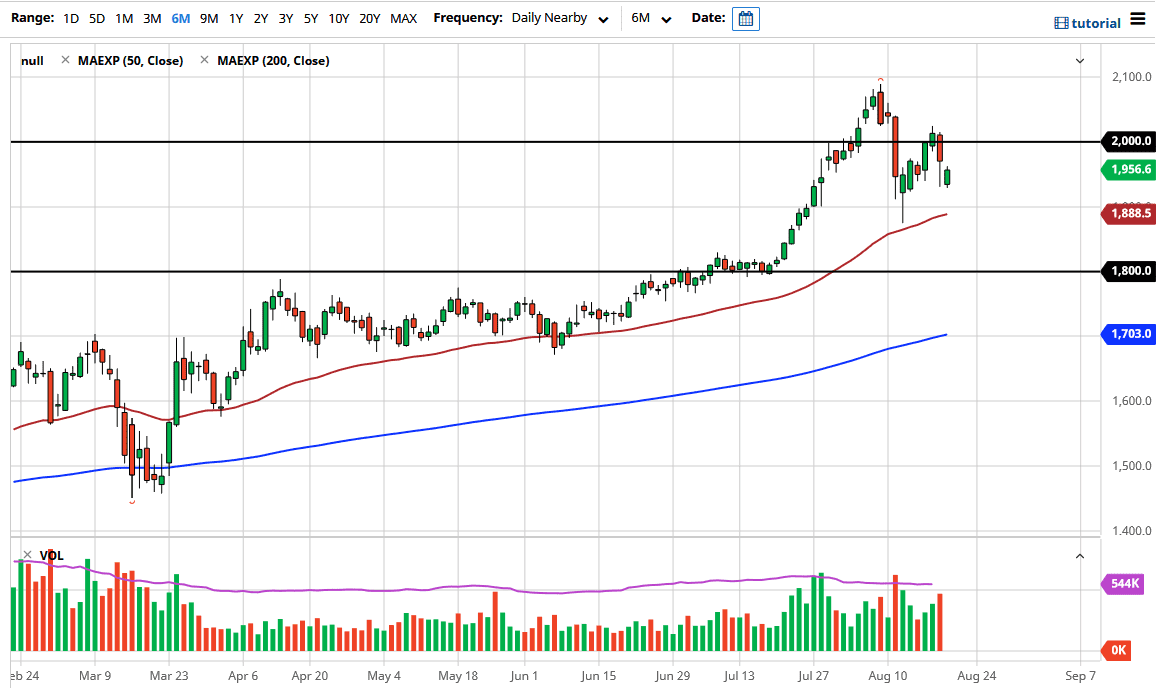

Gold markets have gapped lower to kick off the trading session on Thursday, but then turned around to somewhat fill the gap. We saw further to go, but it should be noted that we have seen a lot of volatility in this general vicinity, and the 50 day EMA sits just below that could also offer significant support. All things being equal, the $1900 level will be an area that people pay a lot of attention to due to the fact that there was a massive hammer previously. That hammer of course is a sign of strength and stability, even though we had seen gold markets get hammered.

One of the biggest problems with trading gold recently is that it will sometimes break down rather drastically when people need to cover losses in other markets. This is because it is one of the few markets that has worked consistently, so thereby you have to worry about the potential of margin covering in other markets taking a massive chunk out of this market. That being said, we are still very much in an uptrend and I believe that it is not until we break down below the $1800 level that we have to think about the alternative.

I also recognize that the $2000 level does offer a certain amount of psychological significance to it as well, so having said that it makes quite a bit of sense that we could see the market try to get there, and then perhaps grind back and forth from that level. Longer-term, I think that we do make fresh highs, because we certainly have a lot of things out there that could drive gold higher, not the least of which is all of the quantitative easing. Beyond that, we also have a lot of concern out there when it comes to global growth. The coronavirus situation also continues to cause havoc in the world to cause a bit of demand for safety as well. Beyond that, we also have central banks around the world buying gold as quickly as they can as well, offering a bit of a support level. At this point in time, I continue to buy dips although the last couple of big red candle certainly have been a shot across the bow of buyers.