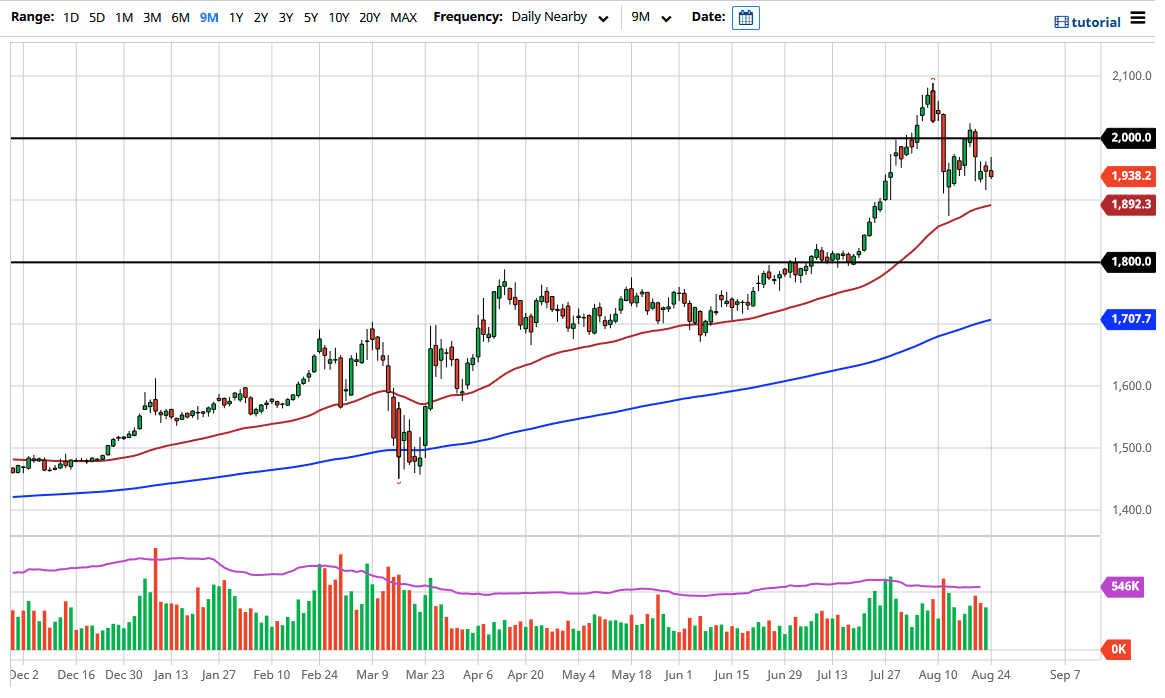

Gold markets have initially tried to rally during the trading session on Monday but gave back quite a bit of the gains as the US dollar strengthened. At this point, it does look like the US dollar is likely to continue strengthening, and that of course works against gold. This is not to say that gold is going to collapse, rather that it probably needs to build a little bit of a base before it goes higher again. After all, it had gotten a bit overextended, and then fell hard.

Since then, we have made a “lower high, and now the question is will we make a lower low? We do not know yet, but it would also be a break at the 50 day EMA to the downside, so it looks likely that would kick off more selling. I do believe that this is a market that will eventually find buyers, and certainly I see the $1800 level as an area of extreme importance. Ultimately, I would be a buyer of massive quantities closer to the $1800 level, as it is an area that has been important in the past because we broke out from that level, tested it for several days in a row, and then shot straight up in the air. We have not been back to retest it for support, so I think it will be interesting to see how it holds up.

For what it is worth, is not just the US dollar that could be driving up gold in the future, we have plenty of central banks around the world trying to flood the markets with liquidity, thereby driving up the value of precious metals and “hard assets.” The shape of the candlestick is less than impressive, so I do believe that we may have a little bit of negativity ahead of us, but again, as the gold trend has been so strong, I think it is only a matter of time before people would rejoin the fray. Beyond that, we also have a lot of concerns around the world when it comes to risk and virus counts, so that could of course have an influence on the safety trade, meaning that people may be buying gold to protect their wealth. Either way, I do not see a fundamental reason for gold fall anytime soon, but we may get a short-term pullback.