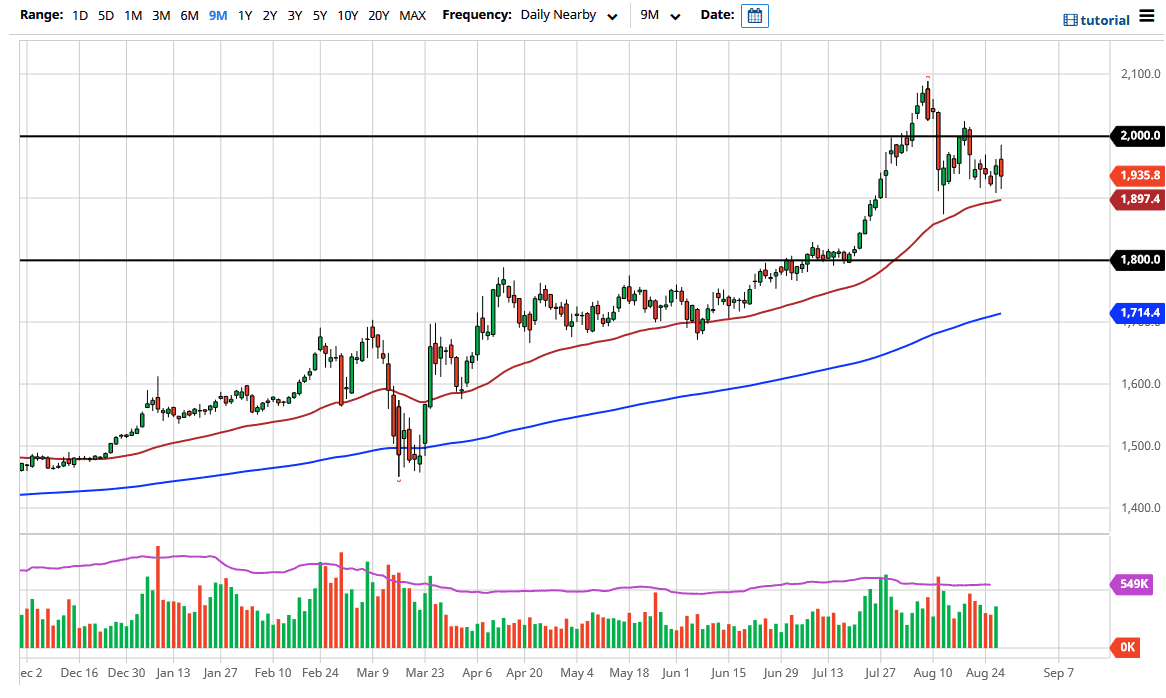

Gold markets initially shot higher during the trading session on Thursday as traders anticipated the Jerome Powell speech and whatever reaction the markets may have to it. With this, I think the are trying to front run the potential announcement but got stuffed when Powell did not offer some type of new quantitative easing. With that in mind, it looks like larger position traders ran the market up and then “handed the bag” to the retail traders. The market fell apart but has since recovered. The longer-term uptrend should continue to be a major factor, and the fact that the $1900 level has shown itself to be supportive enough to cause a bit of a bounce later in the day. In fact, what once looked like a very negative candlestick suddenly looks somewhat appealing.

If the US dollar continues to fall, then this should continue to go higher as well. Ultimately, I think that the $2000 level will be the target, and if we can break above there then we can open up the floodgates and go much higher. If we break down below the 50 day EMA, then the market could have a bigger move and perhaps drop this market down towards the $1800 level.

That is an area that I would be much more aggressive about buying, because it would offer so much in the way of value and it is the scene where we had seen a major breakout previously. With that being the case, it is very likely that a lot of traders would start to experience “FOMO” giving another opportunity. I do not know that we get down there, but that is without a doubt my favorite scenario. Furthermore, it becomes a longer-term trade because initially people will be afraid to do it, and then will jump on and start getting that “FOMO” yet again. I do recognize that a break above the $2000 level will probably kick off the next leg higher, so I do not really have a scenario where I am going to be a seller anytime soon, but my best case scenario is that in the short term we go sideways in this general vicinity, trying to figure out whether or not this rally continues soon, or if we need to build up more of a base in order to take advantage of it.