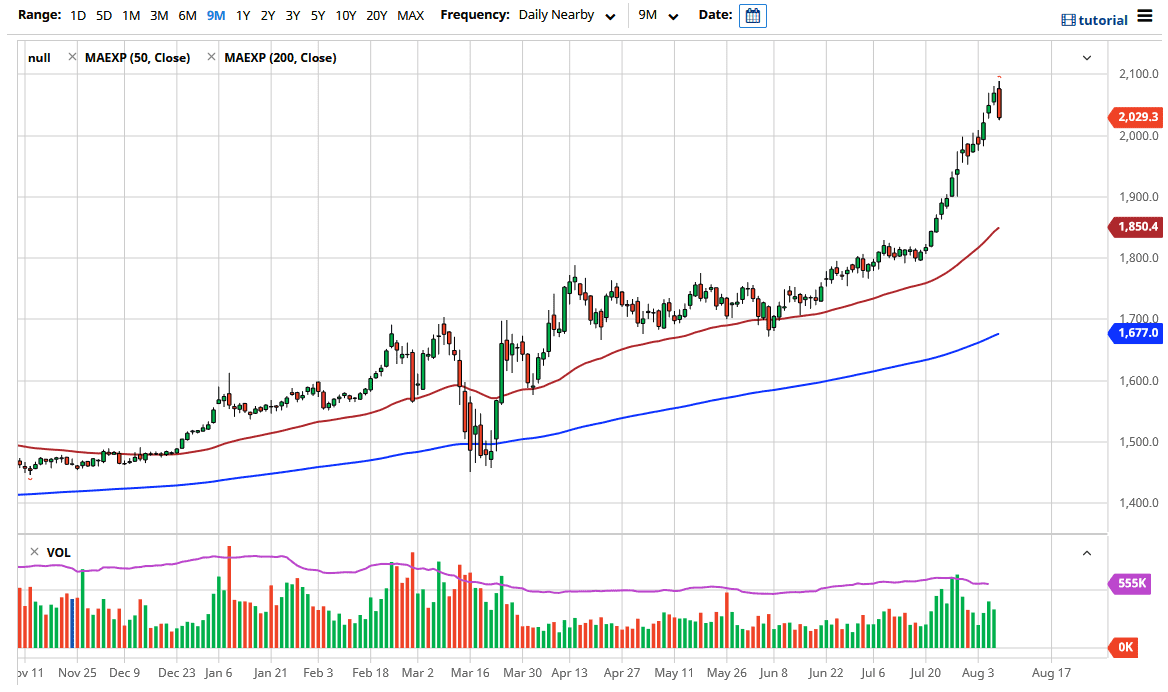

Gold markets have formed an engulfing bearish candlestick during the trading session on Friday, showing signs of weakness. This is a major negative sign, and a breakdown below the candlestick would be the market ready to go down towards the $2000 level. The $2000 level is psychologically important and something that you should be paying attention to once we get there. If some type of bounce happens in that general vicinity, then I think we will continue the uptrend. However, if we break down below there then I think there are various areas that we could be looking towards in order to go long again. The $1925 region is an area that should continue to see buyers as well, as there is a little bit of a gap in that general vicinity.

Keep in mind that the value of the US dollar continues to get hammered, so that has been the main driver of gold going higher. The Federal Reserve continues to print US dollars, thereby devaluing the currency. The gold market is priced in US dollars, and therefore it makes sense that we would continue to see the commodity rise. In fact, we have seen several commodities rise in value, and that should continue to be the case going forward. Nonetheless, markets cannot go straight up in the air forever, be it gold, oil, or anything else. With that, I think that a healthy pullback is coming and there are plenty of people out there that would be more than willing to pick up value if it shows up.

Even if you told me that you knew gold was going to break down tomorrow, I would not be a seller because it is much easier to simply pick up value as it occurs. Fighting a tidal wave of buying pressure is a great way to lose money, something that I have no interest in doing. I believe that the “floor” in the market is somewhere near the $1800 level, so it is not until we break down below that level that I would be concerned about the overall uptrend. Furthermore, we would have to see some type of strengthening of the US dollar in order to expect gold to fall for a significant amount of time. In other words, use a little bit of patience and take advantage of cheaper gold once we get to a stable place.