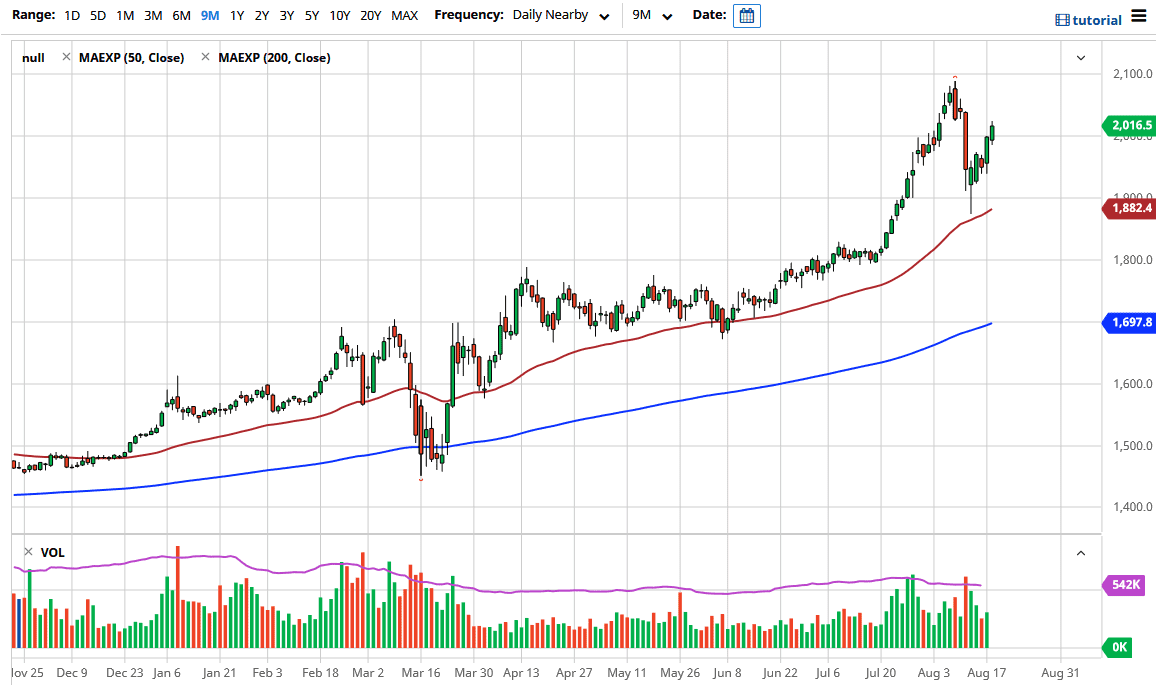

Gold markets have rallied a bit during the trading session on Tuesday, breaking above the $2000 level yet again. At this point, I think the short-term continues to see plenty of buyers underneath, and I think that the $2000 level will be a significant area that people will be paying attention to. Even if we were to break down below there, I believe there is more than enough support underneath that you simply cannot short this market. The $1900 level underneath features not only the hammer from the previous pullback after selling off so brutally, it now features the 50 day EMA approaching it so I think that is essentially going to be your “floor” in the market right now.

The $2100 level above is a significant barrier to overcome, and if we were to do so that would show that we are ready to continue to kick off the next leg higher. Regardless, this is a bullish market and it is difficult to start shorting anytime soon as although we will get the occasional pullback, there should be plenty of buyers who have missed out on the move higher and will be looking to get involved. There was serious “FOMO” previously, and therefore I think we will continue to see buyers jump in as they realize that the bounce shows that even with the massive selloff last week, it looks as if stability has come back into the marketplace.

That is not a huge surprise, because the market got a bit parabolic. When we have a parabolic move like this, it makes quite a bit of sense that we need to resolve the momentum, and selloff in order to get rid of the “weak hands.” With that being the case, I like the idea of picking up value as we go along, as the gold rally suggests that we have further to go due to not only the Federal Reserve but the fact that central banks around the world continue to push the issue and flood the market with monetary policy. I like the idea of a move towards $2500, which is my longer-term target. The 50 day EMA has been extraordinarily bullish and has been nice support more than once. As long as we can stay above there, the way of a really good shot at granting to the upside. Remember, markets undulate, but they do trend. Trending is what we are seeing here.