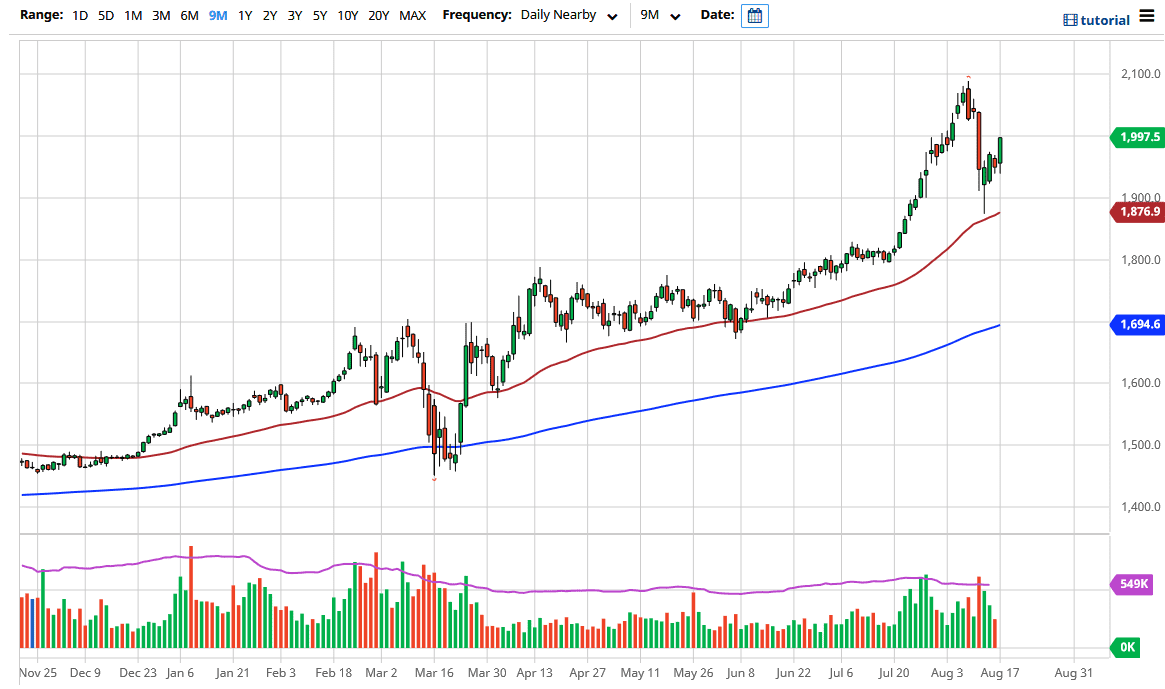

Gold markets have pulled back a bit initially during the trading session on Monday but then rallied quite significantly. By doing so, the market reached towards the $2000 level. That is a large, round, psychologically significant figure, and if we can break above there then it is likely that we could continue to go much higher, perhaps reaching towards the highs that we had set just a couple of weeks ago. That being said, I think it is only a matter of time before the buyers step in, especially if we break above the $2000 level as it is a psychological victory.

I think that there are plenty of buyers on dips, especially down to the $1900 level, an area that I think now serves as a bit of a “floor the market”, perhaps followed by the 50 day EMA just underneath there. After all, the hammer that formed from last Wednesday was a very bullish sign and it was a great way to stabilize after such a massive selling of the commodity on Tuesday. With all that being said I believe that simply buying on dips will continue to be the best way going forward, as the market participants are looking for opportunities to pick up “cheap gold”, it has become overbought.

If we did break down below the candlestick from last Wednesday, it would be an extraordinarily negative sign, but I think there is even more support down at the $1800 level. With all that being said I think it is only a matter of time before we rally, and therefore I do not have any interest in shorting this market. In fact, I look at short-term pullbacks as gifts from the market in order to get involved in what is obviously a longer-term bullish move.

I think that it is only a matter of time before we get back towards the $2100 level, but if we were to break out above there, then the $2250 level would be the next target. Ultimately, I think we can go as high as $2500 over the next several months, but that does not mean that we get there overnight. When I look at this chart, I see absolutely nothing on it that tells me I should be a seller or that the trend is over.