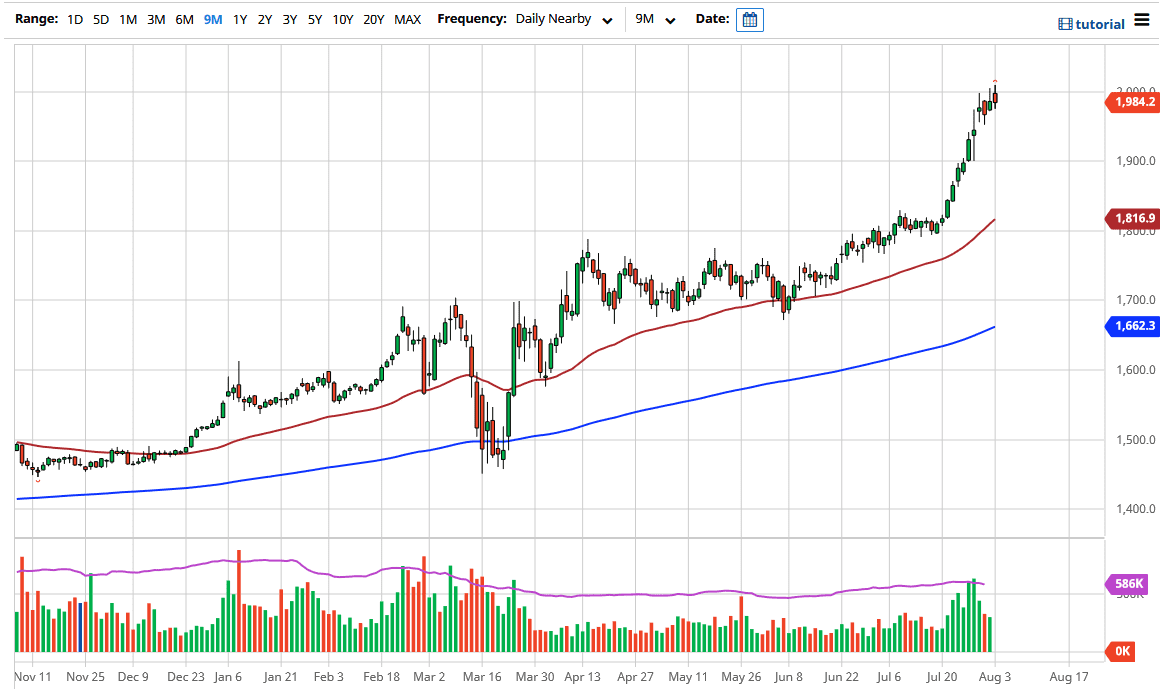

The gold markets have touched the $2000 level a couple of times over the last couple of days, but we cannot seem to hang on to the gains above there. That is not a huge surprise, because it is such a psychologically and structurally important figure. Given enough time, I do think that we will break through there but obviously we have gone straight up in the air until the last couple of days, so let us keep in mind that at the very least we need to get used to the idea of being at this high level before continuing to take off. At this point, I think that we could pull back, and I think that offers plenty of value.

The $1950 level makes quite a bit of sense for support, as it was the scene of a gap previously. That tells me that there should be plenty of buyers in that area, but it is not necessarily going to hold as it is still relatively elevated. Gold continues to have a great trading environment, as you can buy dips on short-term charts and take quick profits. However, if you are looking for a longer-term investment, then you need to see one of two things happen: A significant pullback, perhaps even as much as $200, or the market going sideways for a while. At this point, it is very unlikely that you can sell this commodity with any type of comfort, so simply looking for value or waiting to see whether or not we get some type of sideways grant before a major impulsive candlestick to the upside. If we can get a daily close that is well above the $2000 level, then it is likely that we go much higher.

As long as the Federal Reserve continues to liquefy the markets with cheap money, it is difficult to imagine a scenario where gold falls for any significant amount of time. In fact, I look at the gold markets as one that offers plenty of opportunities every time it pulls back because it has been in such a strong uptrend for so long. In fact, it is not until we break down below the $1700 level, which is $300 underneath, that I would even remotely consider shorting this market, and therefore it is worth noting that this is a “long-only” type of scenario.