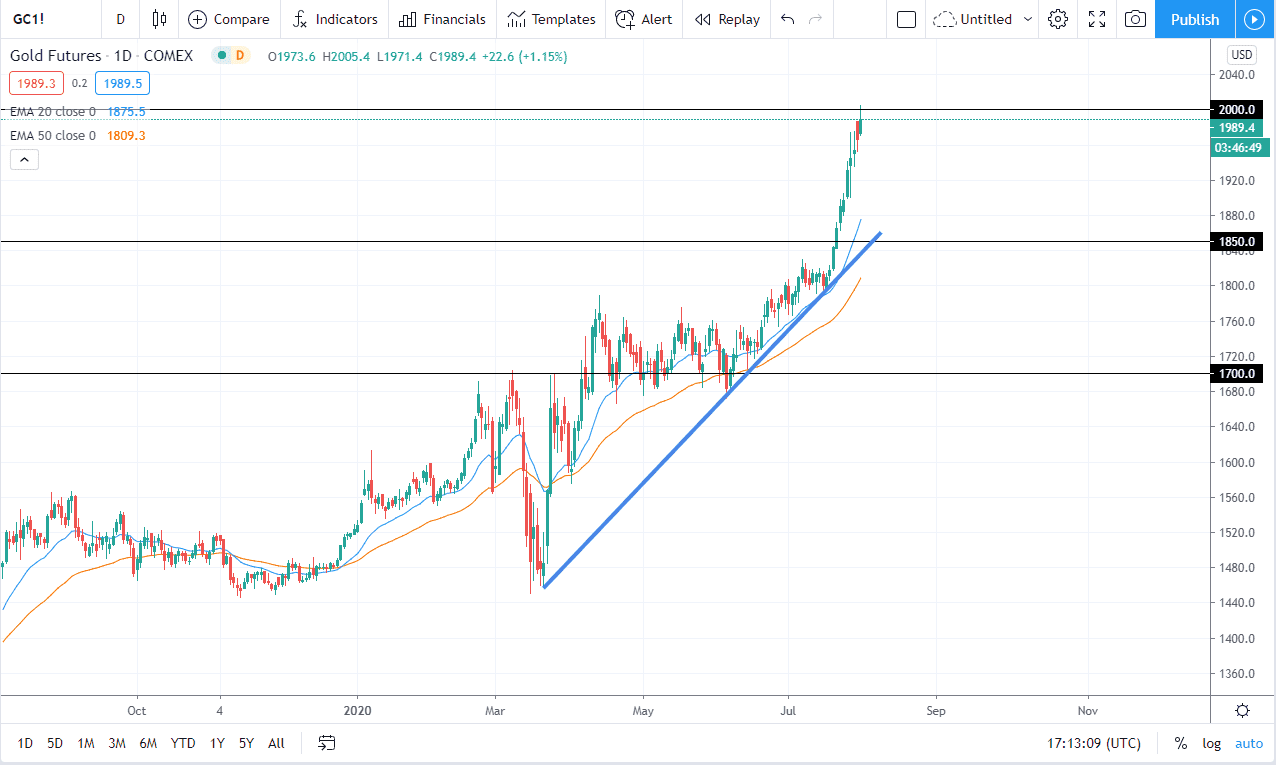

The gold markets rallied significantly during the trading session on Friday, touching the $2000 level before pulling back. Ultimately, this is a market that has hit a major milestone, and it makes quite a bit of sense that traders would take profit, especially considering that it was a Friday and a lot of them do not like carrying risk into the weekend itself. That being said, I think it is only a matter of time before buyers return, but we desperately need to see some type of significant pullback so that we can find value. After all, “paying up” is one of the easiest ways to lose money, especially when it comes to the futures market.

The uptrend line should continue to come into play, but we are quite a way from there so I think that it is only a matter of time before traders will get involved, perhaps closer to the $1925 level, maybe even down to the $1900 level. I like the idea of finding some type of supportive daily candlestick, and I think that the massive amount of traders that have missed this move. After all, “FOMO” is one of the main drivers in markets that are extraordinarily bullish as this one is.

The US dollar has sold off so much to the point where we will more than likely see some type of recovery in the greenback, which of course we have already started to see late in the week. That could send gold lower and that could be the catalyst for cheaper prices. At this point in time I have no scenario in which I am willing to sell gold, just as I have been saying for several hundred dollars. The $1850 level is probably going to be the “floor” in the market. While we could simply break through the $2000 level go much higher, that would probably be more of a “blow off top” than I would be willing to stomach, because of this almost always in an extreme move to the downside. Simply being patient will probably be the best way to be profitable here, because the trend is set, so now it is only a matter of buying gold when it offers itself as being “cheap” for the short term. The Federal Reserve does not look likely to change its attitude anytime soon, so this is a one-way trade.