The convergence between the United States of America and China and the gains in global stock markets, amid announcements of vaccines that eliminate the COVID-19 pandemic, investor appetite for risk, and the strength of the US dollar, are all factors contributed to pushing the gold prices to retreat towards $1914 support before settling around $1932 an ounce at the time of writing. Investors are in a cautious waiting position until important statements are received from US Federal Reserve Governor Jerome Powell in order to obtain more indications regarding US monetary policy. Powell is expected to speak online at the annual Jackson Hole symposium sponsored by the Kansas City branch of the Federal Reserve. This meeting will be the main platform for a massive environmental announcement over the past few months.

The US central bank does not appear to make any further expansion of its stimulus package in the short term. Alternatively, the Fed may adopt a yield curve guiding system as it shows that it will absorb the rise in inflation early in advance before withdrawing support. Perhaps this trend reflects the authority’s acceptance of monetary policy restrictions, so easing will undoubtedly support demand, but it will create it immediately.

Impressive German data, positive news about the Coronavirus, and signs of progress in trade negotiations between the United States and China also affected the appeal of the yellow metal as a safe haven. A positive review of German GDP data for the second quarter and a further increase in the IFO Business Climate reading helped ease investor concerns about economic recovery.

On the other hand, American biotechnology company Moderna said it has concluded advanced exploratory talks to provide 80 million doses of the experimental coronavirus vaccine to the European Union. From the United States, the Office of the US Trade Representative said in a statement that the United States and China are witnessing progress and are committed to taking steps to ensure the success of the Phase 1 trade agreement between the two.

The US Commerce Department announced that trade envoys from the United States and China discussed strengthening coordination of their countries' economic policies during a telephone meeting on Tuesday. The announcement did not mention any details of the meeting held within the framework of the "Phase 1" truce, which aims to end the tariff war between the two largest economies in the world that disrupted global trade. The government of Chinese President Xi Jinping has been pressing Washington since at least 2016 to coordinate macroeconomic policies. Beijing did not provide any details, but such policies could include economic growth, employment, inflation, and trade.

The ministry said in Tuesday's meeting included Vice Premier Liu He, US Trade Representative Robert Lighthizer, and Treasury Secretary Stephen Mnuchin. "The two sides held a constructive dialogue on strengthening coordination of the two countries' macroeconomic policies and implementing the first phase agreement," a ministry statement said. Under Phase 1 agreement signed in January 2020, the two governments agreed to suspend additional sanctions on each other's goods in a battle launched by President Donald Trump in 2018 over Beijing's technology ambitions and trade surplus.

This agreement remained in effect despite a growing array of harassment in US-China relations, including the Hong Kong situation, the handling of the Coronavirus pandemic, and accusations of human rights violations in the Muslim province of Xinjiang in northwest China. For its part, Beijing promised as part of the "Phase 1" agreement to narrow its trade surplus with the United States by purchasing more American agricultural commodities. In this regard, Trump's economic adviser, Larry Kudlow, told reporters last week that the White House has been satisfied with Beijing purchases so far.

The truce called for talks six months later, but these were postponed due to the Coronavirus pandemic. A meeting that had been scheduled for last week had been scheduled to take place online but was postponed. The two governments have yet to announce plans for face-to-face talks in the next phase of negotiations. Accordingly, the two governments have removed some sanctions, but most punitive tariffs imposed on hundreds of billions of dollars of each other's goods remain in effect.

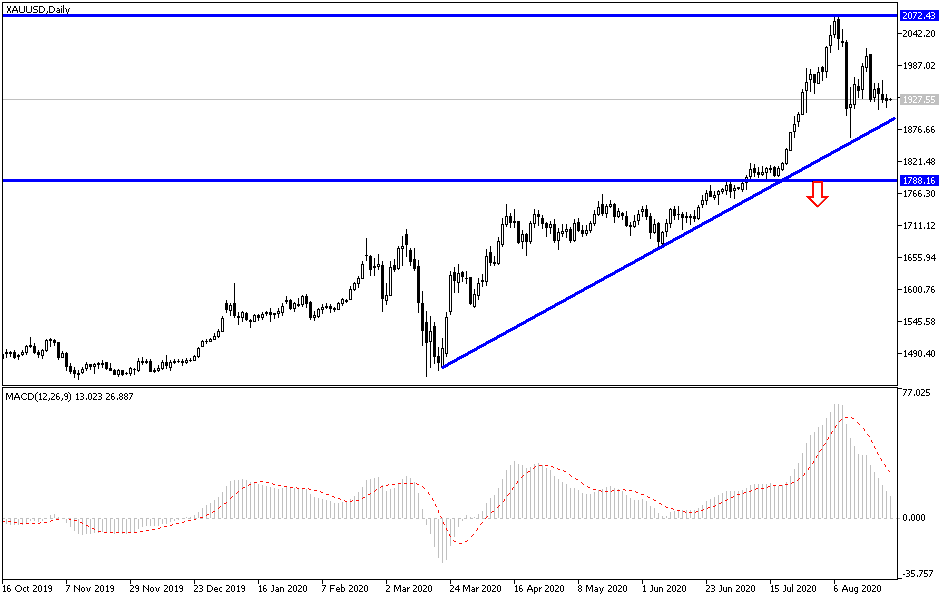

According to the technical analysis of gold: the stability of the gold price above the $1900 resistance still supports the bulls' control over the performance, and the following resistance levels at 1947, 1965, and 2000 are still important targets for the bulls' continued control of the trend. A real reversal of the bullish trend may happen if gold moves towards the support levels of 1885 and 1855, respectively. The factors behind the gains of the yellow metal are still in place, and therefore I still prefer to buy from every lower level. It must be taken into consideration, and as is evident on the daily chart, gold has a head and shoulders shape that may technically support upcoming sales. Gold will interact today with the announcement of US durable goods orders and investors’ risk appetite.