The strength of the US dollar contributed to the decline in the price of gold to the $1961 an ounce after a rush at the beginning of trading towards $1985 an ounce. It was stable at around $1968 at the time of writing. Gold trading varied during yesterday's session as optimistic manufacturing data from the Eurozone, China, Britain, and the United States of America, helped alleviate fears about the global economic recovery. The downside, if any, remained capped amid fears of further tightening restrictions in Europe and a stalemate in the deliberations on the new stimulus package in the United States.

A special survey showed that factory activity in China grew at its fastest pace in nearly a decade in July, which helped ease concerns about the Covid-19 pandemic on the global economy. Final data from IHS Markit showed that the Eurozone manufacturing sector returned to growth in July, for the first time in a year and a half, as production and demand continued to recover with further easing of restrictions related to COVID-19 disease.

The Manufacturing PMI rose to a reading of 51.8 in July from 47.4 in June. This was also higher than the expected reading of 51.1. UK manufacturing was also on the road to recovery as the country’s closure eased and employees returned to work. Accordingly, the IHS Markit/CIPS Manufacturing Purchasing Managers index rose to a reading of 53.3 last month from 50.1 in June.

On the COVID-19 outbreak front, more countries have imposed new restrictions or extended existing restrictions as cases of infection continued to rise in the United States of America and amounted to about 18 million globally. As the United States enters a new phase of the pandemic, a senior Federal Reserve official urged the Congress on Sunday to work to spend large sums on the Corona relief effort and proposed a new closure. The US Senate is scheduled to suspend a vacation on August 7, leaving little time for Republicans and Democrats to reach an agreement on the latest stimulus package. For his part, White House Chief of Staff Mark Meadows warned on Sunday that he was not optimistic that an agreement would soon be reached on the stimulus package.

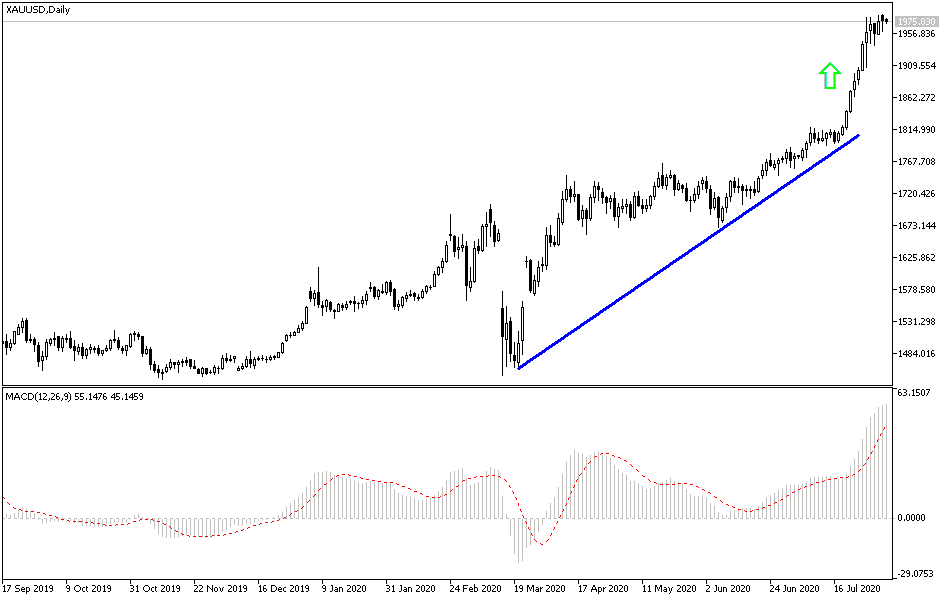

According to the technical analysis of gold: The general trend of the gold price is still bullish and stability above the $1900 psychological resistance will pave the way for testing new records and historical highs. Gold prices reaching the $1985 resistance increased expectations that gold may reach beyond the next historic resistance level at $2000 an ounce. The World Health Organization's concern about the future of eradicating the COVID-19 pandemic adds to the gold stimulating factors, including tensions between the United States of America and China, continued stimulus from global central banks and governments, concern about Brexit’s prospect and the US presidential election.

For the time being, the downside areas will remain important to buy gold again and the closest support levels are now at 1958, 1940, and 1910, respectively. Gold will react today with the announcement of the Reserve Bank of Australia monetary policy, US factory orders numbers, and whether or not investors are taking risks.