After the expected announcement by Federal Reserve Governor Jerome Powell of important adjustments to the bank’s monetary policy in the era of the COVID-19 pandemic, the effects of which outweighed the global financial crisis during 2008-2009, the US dollar reaped strong gains that contributed to the drop in gold prices to the support at $1910 dollars an ounce. The markets believed that this decline would not last for long, as the US dollar quickly declined strongly with the market’s absorbing what Jerome Powell announced. Accordingly, gold prices had a better chance to move up to the $1974 resistance before closing the week’s trading around the $1965 level per ounce. Renewed tensions between the United States of America and China were an additional feat for the yellow metal.

After climbing the stage at the annual Jackson Hole Economic Symposium, Fed Chairman Jerome Powell outlined various changes in the bank’s monetary policy framework under which the US central bank will for the time being continue to manage monetary policy decisions using average inflation targets rather than identical targets. This may lead to a sharp increase in inflation as it exceeds the 2% target after a period of low inflation, below the 2% target.

In general, low-interest rates, extraordinary financial incentives, accommodative monetary policy, and geopolitical tensions have kept gold prices on their historical gains. In contrast, this technical environment that fuels gold's rise to new record levels is showing very little signs of fading, as Jerome Powell, Chairman of the Federal Reserve Board, unveiled the updated fiscal policy approach of the Federal Reserve that will try to raise the rate of inflation to 2%. In his speech, during the annual Jackson Hole symposium, Powell indicated that the inflation rate will continue to fall from the 2% target in the long term with more reasons for concern, and he also mentioned that inflation is very low and may pose significant risks to the economy leading to an unexpected drop in inflation expectations on the long-term.

With inflation expectations critical to give the US central bank some needed leverage to support employees when necessary, the Fed is now choosing to introduce flexible forms of Average inflation targeting (AIT). Average inflation targeting allows the FOMC to extend the current accommodative fiscal policy measures after increasing periods of below-target prices to achieve a moderate inflation rate of over 2% for a short period of time.

Looking at the Federal Reserve’s gauge of price growth, this has largely underestimated the new target since the current was adopted 8 years ago, and it appears that the current five-year projection for inflation is at just under 1.8% of low-interest rates which will remain in the near future.

Although the US central bank’s intolerance of increasing inflation levels is usually bullish for gold prices, Powell’s statement that if the inflationary pressure becomes excess, in short, they will not hesitate to take further measures, which may cause concern for gold investors.

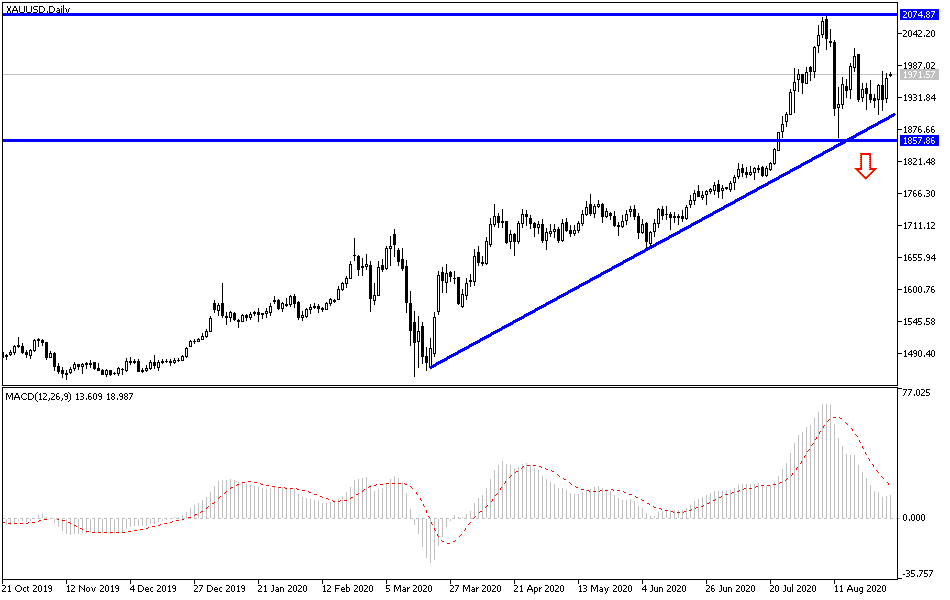

According to the technical analysis of gold: In the long run, the price of gold is still within the range of its strong ascending channel, and as I mentioned before, factors of continuing its gains are still in place, and the historical resistance of $2000 an ounce is still an important goal for bulls control, and at the same time, technical indicators push into strong overbought areas and are expected to start thinking about selling operations, pending the correction, to reap profits. For the time being, the resistance levels in 1982, 2000, and 2025 will remain the closest to the bulls. As I mentioned before, I confirm now that the support levels of 1885 and 1860 dollars are important to cause a real and initial reversal of the current trend.