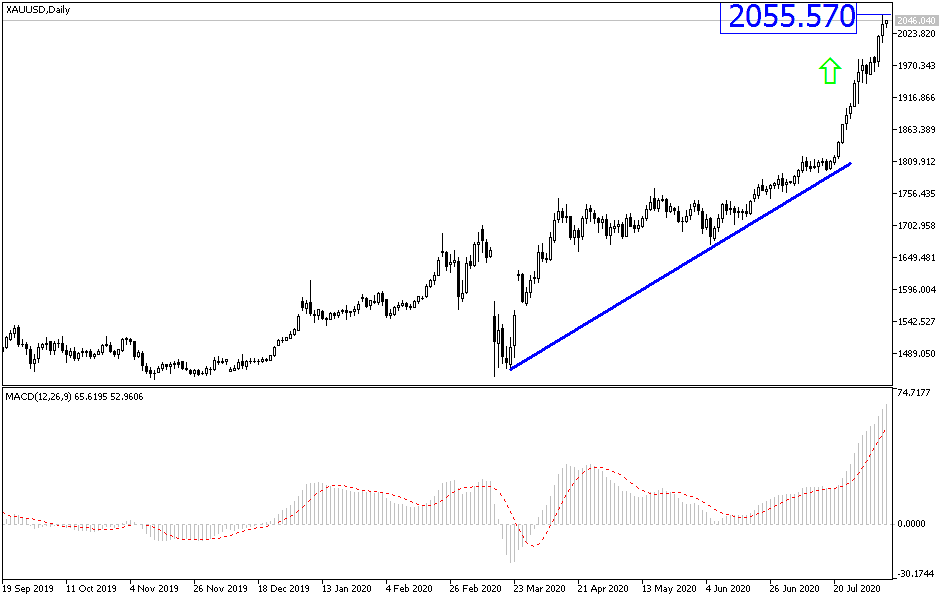

Gold price performance broke all accepted trading rules and analysis. Despite the beginning of the gold price correction movements since mid-March, starting from the $1460 an ounce, the yellow metal has been continuously harvesting gains ever since, until it was capped by testing the $2055 an ounce, the highest level in the history of gold. It settled around the $2035 an ounce at the time of writing. The metal was indifferent to the technical indicators reaching sharp overbought areas and remained adhering to its record gains, as the rules are that the arrival of prices to such a situation is followed by profit-taking sell-offs, which has not happened with gold yet. Yes, gaining factors still exist, but usually selling operations occur and push gold back to new support areas to form a base to complete the launch to the top.

Gold prices continue to climb. Optimism about US lawmakers ’approving the stimulus package and the weakening dollar were important factors in achieving those gains. The dollar index DXY fell to a low of 92.56 before recovering some losses. Silver futures rose to $26.890 an ounce, while copper futures rose to $2.9170 a pound.

There is some optimism that US lawmakers will eventually reach an agreement on a new bill to counteract the effects of the COVID-19 virus. Democratic leaders said they continue to make progress toward reaching an agreement after meeting with Trump administration officials on Tuesday. For his part, Senate Minority Leader Chuck Schumer said from New York: "We are making progress. We really went on issue after issue, and got over it."

Schumer's comments came after Senate Majority Leader Mitch McConnell of Kane indicated that he would support any agreement between Democrats and the White House.

On the economic side, according to a report by the ADP Payroll Wizard, private sector employment increased by 167,000 jobs in July after rising by 4.314 million jobs, upward adjusted, in June. Economists had expected jobs to increase by another 1.5 million jobs, compared to the 2.369 million increase in jobs reported in the previous month. Data from the Commerce Department showed that the US trade deficit narrowed in June. The Ministry of Commerce said that the trade deficit narrowed to $50.7 billion in June from $54.8 billion in May.

A report from the Institute of Supply Management showed that the pace of growth in the services sector unexpectedly accelerated in July. ISM said its non-manufacturing index rose to a reading of 58.1 in July after rising to 57.1 in June. Economists had expected the index to drop to a reading of 55.0.

According to the technical analysis of gold: No change in my technical view of gold prices. The trend is still bullish, and investors are awaiting for profit-taking selling to push the price to new buying areas instead of waiting for new records. The closest resistance levels to gold performance may now be at 2065, 2080 and 2120 respectively. It is not possible to talk now about a level where the trend will reverse, but only the awaited selling that will push the price to new buying areas to move within the current ascending path. Without a vaccine for the Coronavirus, there will be no real collapse of the bulls’ control, the end of the conflict between the United States and China, and the return of the strength of the US dollar.

In addition to what has been mentioned, gold will interact today with the Bank of England's announcement of its monetary policy and the statements of its governor, then the number of US jobless claims.