Yellow metal bulls succeeded in pushing the price of an ounce of gold towards the $1983 resistance, its highest level in history. With a limited uprising of the US dollar after its recent collapse, gold price fell to $1960, an ounce before closing trading around $1975 dollars. The yellow metal is still supported by the COVID-19 impact on the global economy, the decline in the US currency, and tensions between the two largest economies in the world. The uncertainty that dominates the global financial markets due to the negative economic effects of COVID-19 will support gold for a longer period. There are strong indications for the start of the second coronavirus wave, and the United States of America is still the world leader in cases and deaths from this deadly disease.

The economic performance of the United States of America, despite the reopening of economic activity, is still sending mixed signals. Last week, better than expected figures were announced for US durable goods orders for June, expectations were at 7.2%, while the reading was at 7.3%, while orders for non-defensive capital goods surpassed expectations of a 2.3 % reading with a reading of 3.3%. On the other hand, the US second-quarter GDP growth rate missed expectations of 1.1% with a contraction of -2.1%. The second-quarter annual GDP exceeded expectations by -34.1% with a contraction of -32.9%. On the other hand, weekly jobless claims exceeded expectations at 1.45 million claims with 1.434 million claims recorded, while ongoing claims missed expectations of 16.2 million recording 17.018 million claims.

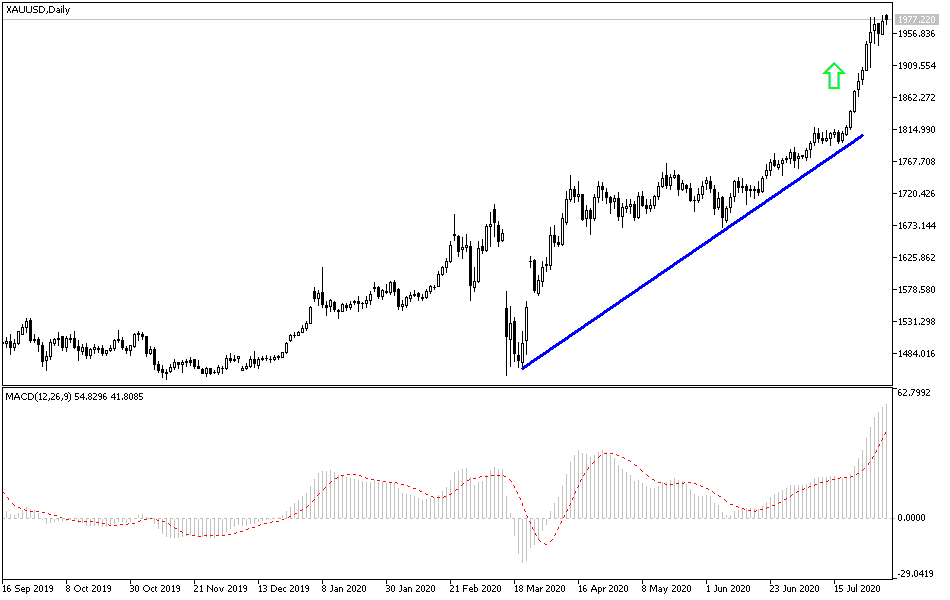

According to the technical analysis of gold today: Bulls' control of gold price performance remains bullish in the near and long term, always taking into account the technical indicators reaching strong overbought areas. The dollar will recover anytime investors begin to take risks, the profit-taking sales will be strong and then Gold bears may move to support levels at 1925 and 1865, respectively. In the long run, the bulls still want to move towards the level of historical psychological resistance, at $2000 an ounce in the near future, and from there to $2100 next after overcoming that resistance.

The price of gold today will interact with the extent of investor risk appetite, the performance of the US dollar, the course of the second wave of COVID-19, US/Chinese tensions, the future of the US presidential elections, as well as the announcement of the PMI reading for the manufacturing sector in the Eurozone, Britain and the United States of America.