The continued USD losses allowed gold prices to return to stability above the $2000 psychological and historical resistance. Gains continued towards the $2016 an ounce before the metal-stabilized around $2005 at the beginning of today's trading. Before the announcement of the US Fed Reserve MoM, where investors are looking for any evidence about a shift in policy expectations, the US dollar tumbled near its lowest level in two years with the continued impasse of US stimulus and the escalation of tensions between the United States and China. The dollar continued its decline for a fifth day, as US Treasury bond yields declined amid concerns about the pace of the economic recovery in the world's largest economy.

The political impasse that has hindered US financial incentives and new restrictions on Huawei Technologies, aimed at cutting off the Chinese company's access to commercially available chips, has also boosted the yellow metal's appeal as a safe haven, as the Trump administration announced at the beginning of this week's dealings that it would tighten restrictions on Huawei's technology in an attempt to limit the company's access to electronic components.

In this regard, US President Donald Trump said in an interview with "Fox and Friends": "We do not want their equipment in the United States because they are spying on us." Commenting on the US actions, Chinese Foreign Ministry spokesman Zhao Lijian said that the United States "violates international trade rules and undermines industrial chains and global supplies." Zhao added that Beijing "will take necessary measures to protect the legitimate rights and interests of Chinese companies." This phrase is often used by Chinese officials during trade disputes but any official action often follows.

For its part, Huawei declined to comment on the recent US action.

This month, the head of its consumer unit, Richard Yu, said its Huawei smartphones ran out of processor chips. Huawei is designing its own chips, but Yu said that production of the more advanced Kirin series will stop on September 15 because the company relies on third-party manufacturers that use American technology. Huawei has removed US-supplied components from its main products after previous sanctions that blocked access to US technology and this week's sanctions extend those controls to include Asian and European components if its manufacturing process uses American technology, which is a common occurrence.

Previous US sanctions prevented Huawei from downloading popular music from Google and other services onto its smartphones. This affected its ability to compete in markets outside of China. Huawei overtook both Samsung and Apple to become the best-selling smartphone brand for the first time in the three months ending in June thanks to strong sales in the populous Chinese market, according to Canalys. Sales abroad are down 27% from the previous year.

Huawei, which was founded by a former military engineer in 1987, has denied accusations that it could facilitate Chinese espionage. Chinese officials accuse Washington of using national security as an excuse to stop competition against US tech industries. "The more the United States suppresses Huawei and other Chinese companies hysterically, the greater the proof of these companies' success and the hypocrisy and arrogance of the United States," said Foreign Ministry spokesman Zhao. "We urge the United States to promptly correct its mistakes, stop defaming China and stop suppressing Chinese companies," he added. "The Chinese government will continue to take necessary measures to protect the legitimate rights and interests of Chinese companies."

In addition to the US-Chinese tensions, the yellow metal gained additional momentum from the weakening of the US dollar and global human and economic losses from the continuing outbreak of the COVID-19 pandemic and the temporary halt of global stimulus, which threatens the return of the closure policy to global economies. The latest optimism over the announcement of vaccines to combat the deadly disease evaporated fast.

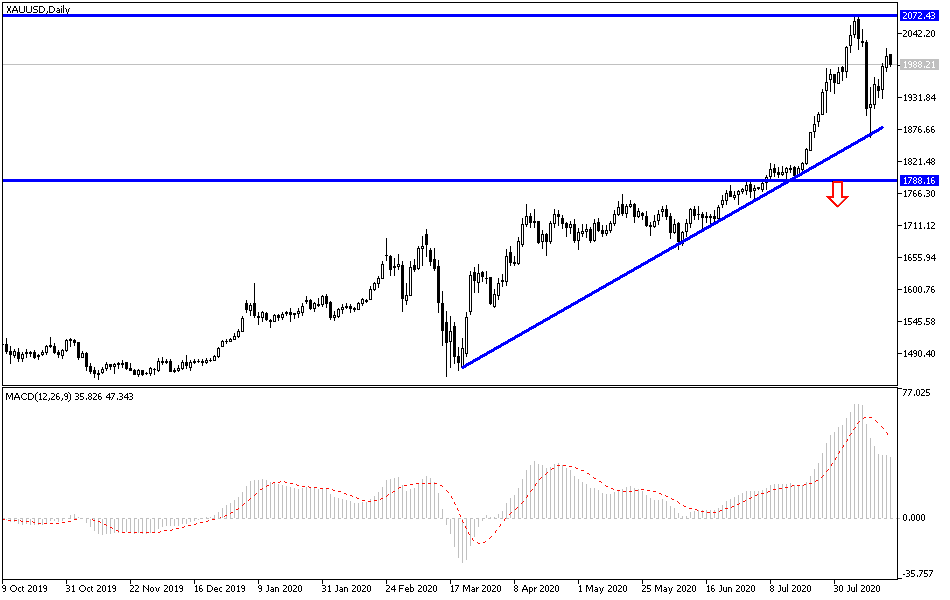

According to the technical analysis of gold: There is no change in my technical view of gold prices, which has the necessary momentum to test new record highs with stability above the $2000 historical resistance. The yellow metal is indifferent to technical indicators reaching overbought areas and interacts more with trade, political and pandemic tensions around the world. The price of the yellow metal is ready to head towards the resistance levels at 2025, 2055, and 2100, respectively. Gold traders are waiting for any decline opportunity to return to buying gold and the closest support levels for gold are currently at 1985, 1960, and 1920, respectively. The metal will interact today with the announcement of inflation figures in Britain, the Eurozone and Canada, then the announcement of the last Federal Reserve Bank’s MoM, and the extent of investor risk appetite.