Gold futures ended yesterday's trading sharply lower in light of riskier assets’ recovery, such as stocks. On the back of hopes about the Coronavirus in the United States and news of Russia registering its first vaccine to counter the virus, the drop in cases of the new Coronavirus in the United States also contributed to weakening the demand for gold. Accordingly, gold price retreated to the $1901 an ounce, and with the beginning of today’s trading, Wednesday, it completed the downward correction and rushed to $1863 an ounce before settling around $1910 an ounce at the time of writing. The collapse in yesterday's trading session is the largest daily decline since March 13. In the same performance, silver futures contracts fell by about 11% to settle at $26,049 an ounce, registering their biggest decline in one session in nearly 9 years. In terms of percentage, silver suffered the largest loss in one session since mid-March 2020.

Financial markets remain hopeful that Republicans and Democrats will eventually agree on a comprehensive stimulus package to limit the economic damage to the United States from the coronavirus pandemic and boost growth. Where leaders and officials in the US Congress and in the Trump administration have said that they are ready to resume Coronavirus aid talks.

In addition to that, reports that Russia registered the first 'Sputnik' vaccine to confront the Coronavirus boosted stock markets’ sentiment and contributed to a drop in precious metals demand. Russian President Vladimir Putin has reportedly said that mass production of the vaccine will be available within weeks and is expected to produce millions of doses in the coming months.

Talks in the US Congress failed to pass another round of federal coronavirus aid, increasing pressure on state and local authorities to continue operating basic services. Nevertheless, US stock markets are near record highs, but analysts attribute that to the Fed's commitment of keeping interest rates low. In contrast, the European Union, which has reduced the number of COVID-19 cases more effectively than the United States, has seen its economy contract at a similar pace but is expected to grow faster next year. The government support for workers has contained the current rise in unemployment. Meanwhile, China was the first major economy to resume growth since the outbreak of the epidemic, registering a growth of 3.2% in the April-June period compared to the previous quarter.

Hopes for a strong and fast recovery have largely been dashed due to the country's inability to control the virus. The United States' diminishing ability to lead global growth is not only related to its response to the Coronavirus but is also eating from its global economic output share. The Chinese economy has grown steadily faster than the US economy and has steadily narrowed the gap between them. From 2009 through 2019, China accounted for nearly 28% of global economic growth; The United States was only at 17%.

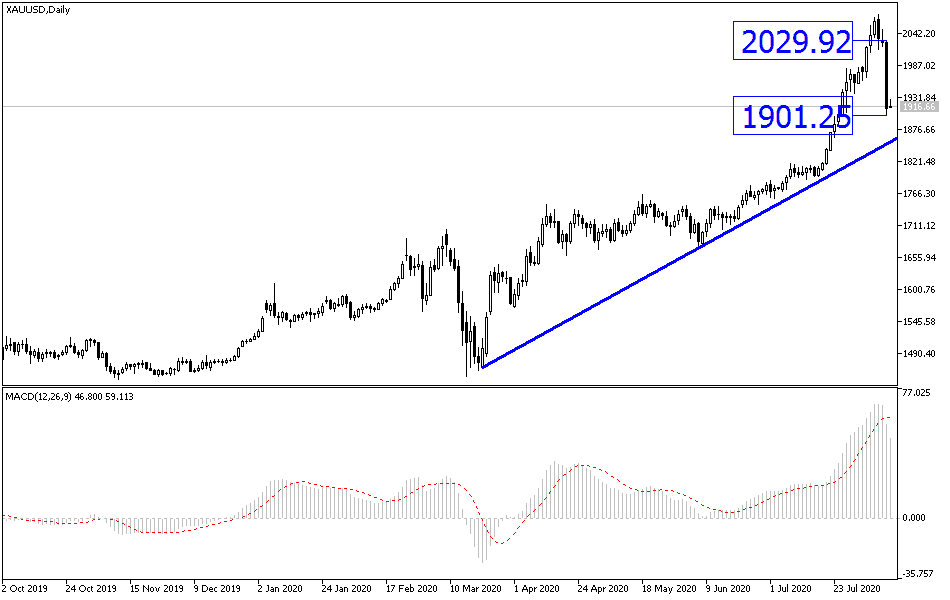

According to the technical analysis of gold: On the daily chart, a technical shift occurred in the price of gold to the downside, with the price of an ounce of gold losing $200 of its value in only two trading sessions. As we expected before, the record rise in gold prices, which pushed it towards its highest levels in history, will be followed by profit-taking selling, and it will also be sharp as it is currently. The question now is when can I buy? The answer is that the continuation of the Coronavirus and its devastating human and economic effects, US political anxiety and US-Chinese tensions will give gold the opportunity to resume gains, and accordingly, the support levels at 1890, 1860 and 1835 may now be the most appropriate to form the starting point again. Historic $2000 resistance will remain a target for bulls to set next record levels.