The strength of the US currency pushed the gold price to retreat towards $1925 an ounce in early trading of Thursday, before stabilizing around the $1945 at the time of writing. Gains at the beginning of the week’s trading reached the $2015 resistance. After this decline, Forex traders are wondering about the most appropriate level to return to buying gold. In general, factors of its gains are still present, and any drop is a buying opportunity to gain from the bounce, and therefore the support levels at 1937, 1920, and 1900 may be the most appropriate for this week's trading.

The US dollar index DXY - which measures the performance of the dollar against a basket of six major currencies - rebounded after hitting its lowest level in more than two years in the previous session amid stimulus uncertainty and concerns surrounding the economic recovery as new Covid-19 cases continued to rise, even if at a modest pace.

Analysts believe that sentiment towards gold remains very optimistic in the medium to long term due to the extremely loose monetary policy pursued by central banks around the world.

According to the Federal Reserve meeting minutes, “Participants generally agreed that the prospects for further substantial improvements in the labour market will depend on a large-scale, sustainable reopening of companies. In return, the reopening will largely depend on the efficiency of health measures to limit the spread of the virus. The task force expected additional fiscal stimulus measures to be passed by Congress, but these have been delayed as the two political parties compete for advantage ahead of the presidential election in November”.

At the July meeting, US central bank officials decided to keep interest rates at zero and maintain monthly purchases of $120 billion in US Treasury bonds and mortgage-backed securities. Fed Chairman Jerome Powell said the central bank "is not even considering raising interest rates." In their discussions, Fed officials noted that there has been an increase in uncertainty about the economic outlook since their last meeting in mid-June.

For his part, the Chairman of the Federal Reserve Board of Richmond, Thomas Parkin, said in remarks after the release of the minutes, that “uncertainty matters a lot to players in the economy." Speaking to the National Economists Club, Parkin added that blue-collar workers "look frozen in place" and says that some business leaders struggle to find workers, even with the unemployment rate being above 10%.”

According to the minutes, “several” Fed officials said that additional monetary easing steps may be required to strengthen the economy. Some said strong financial support would be essential.

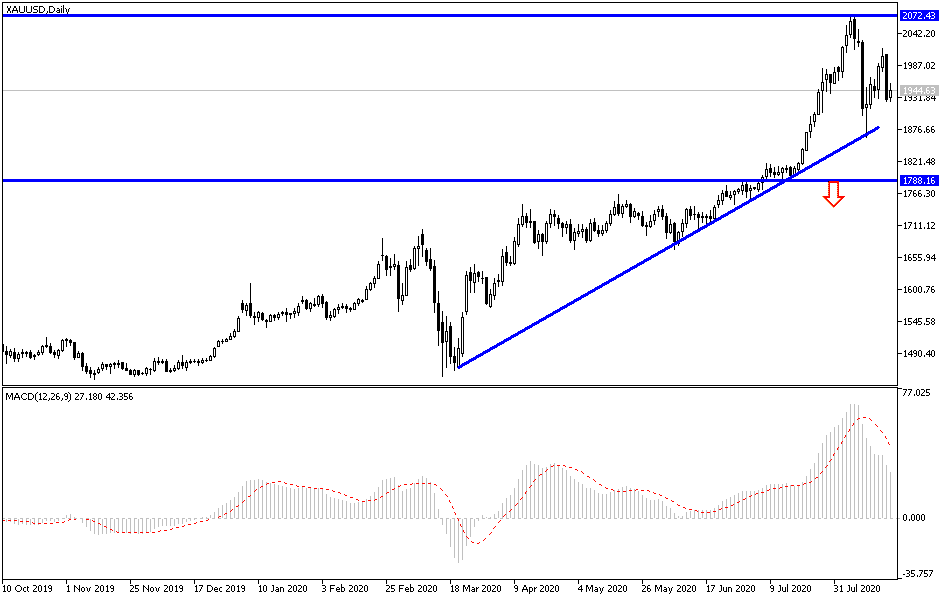

According to the technical analysis of gold: The general trend of the gold price is still bullish and I still prefer to buy the yellow metal from every downward level as the factors of its gains (Coronavirus - global trade and political tensions - continuous economic stimulus - weak US currency - Brexit file - US political anxiety ... and others ) are still standing. The support levels 1938, 1925, and 1910 may be the best places to buy now, and the $2000 psychological resistance will remain an important mark of bulls' stronger control of performance.

As for the economic calendar data today: The largest interaction will be with the US data including be the jobless claims and the reading of the Philadelphia industrial index.