In light of the USD weakness, the opportunity was better for gold and silver futures to move towards its highest closing level in a week, while markets are cautiously awaiting the content of Federal Reserve Chairman Jerome Powell's speech at the Jackson Hole symposium, the most important economic summit that may have a strong effect on gold prices. The price of gold rose to $1955 an ounce after selling that pushed it at the beginning of yesterday's trading session to the $1903 an ounce. This performance confirms the strength of our expectations to buy gold from every descending level, as indicated in the recent technical analyses.

The drop in gold prices yesterday was due to pressure on the background of high bond yields, and the price of gold is stable around $1942 per ounce after the durable goods orders for July jumped 11.2%, much higher than economists' expectations of a 4.8% increase. Commenting on gold performance, Tyler Richie, co-editor at Sevens Report Research, said, “Historically, good economic data is negative for gold, but in this case, real interest rates fell in the wake of the release, as rising inflation expectations exceeded the rise in Treasury yields. This is a bullish dynamic for the gold market.”

Gold price movements come ahead of a very important speech by US Central Bank Governor Jerome Powell, which is expected to provide a more appropriate signal, indicating that the US central bank is ready to embark on an unconventional way of thinking about rising inflation. Also, Powell is expected to defend the so-called disproportionate inflation target, a target that allows policymakers to allow inflation to rise above their traditional annual target of 2%, which can be seen as bullish for gold and other precious metals.

The Fed chairman is expected to deliver a speech online at around 9 a.m. EST today Thursday at the Jackson Hole symposium, which is being held this way due to the outbreak.

As expected reaction to Powell's comments, Geoff Wright, Executive Vice President of GoldMining Inc., said that Powell's speech “could turn the direction of the gold market in both ways, and in the event that his comments were pessimistic, he will support interest rates remain around and below zero. I expect a return to the US dollar drop and the recovery of gold towards $ 2000 an ounce again.”

The decline in the US dollar has given way to gains in gold bullion as a weaker dollar could make the precious metal more attractive to overseas buyers. In general, analysts believe that the natural trend for gold at the present time is bullish, largely due to the increasing global appreciation of how monetary easing and stimulus spending will lead to the devaluation of currencies against the yellow metal.

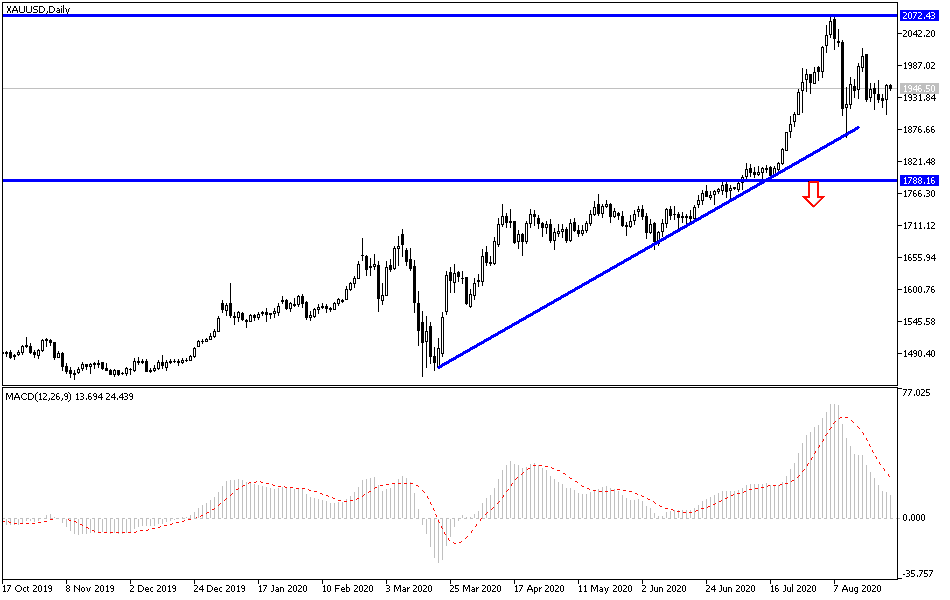

According to the technical analysis of gold: The return of the gold price to test the resistance levels at 1962 and 1975 stimulates the metal bulls to push towards the level of $2000 historical psychological resistance again, thus preparing to talk about stronger historical levels that may exceed the $2075 peak that gold tested at the beginning of this month's trading. There will be no real downtrend reversal without the metal moving towards the $1900 support. With Jerome Powell's upcoming statements, the yellow metal will react first to the announcement of the U.S GDP growth rate, and then the weekly US jobless claims number.