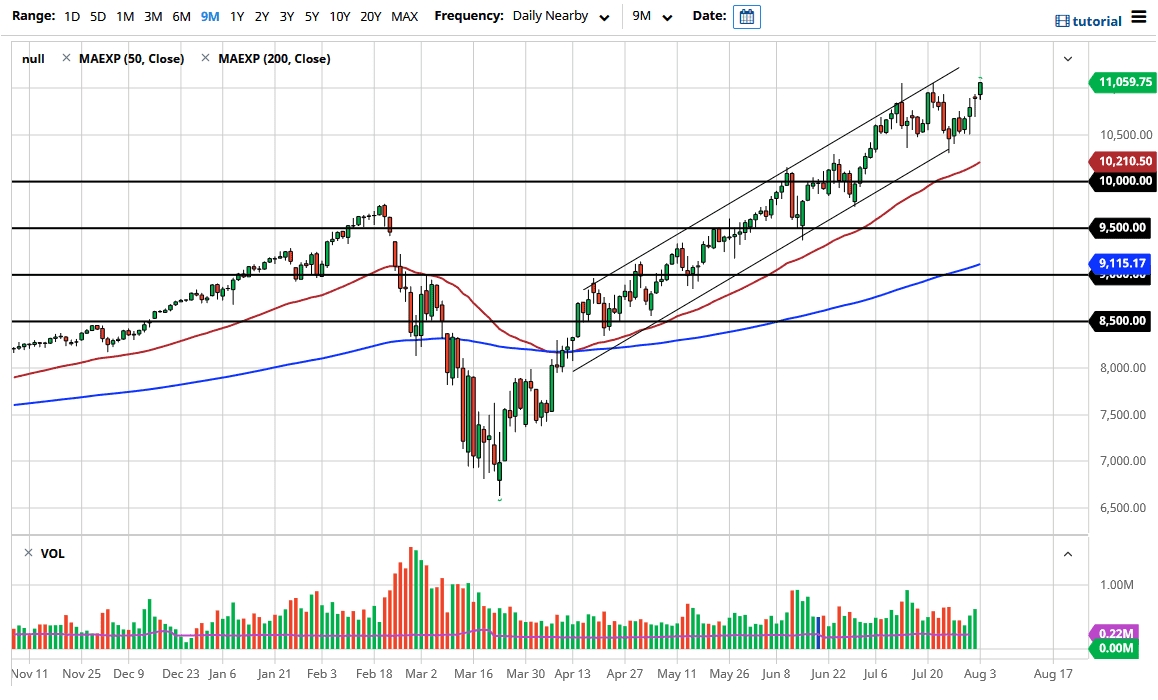

The NASDAQ 100 initially pulled back a bit during the trading session on Monday but then turned around completely to skyrocket above the 11,000 level. That being said, the NASDAQ 100 is getting a bit elevated but it is worth noting that we are in the process of trying to break out above the most recent highs and form a bit of a “W pattern”, something that you typically think about at the bottom of the downtrend. In other words, we may have just accelerated yet again to the upside.

We have been in a channel for quite some time, and now it appears that we will probably go looking towards the top of that channel. If that is going to be the case, then it is likely that what we are going to see plenty of buyers on dips as the market will have momentum on its side. The NASDAQ 100 is driven higher by just a handful of companies, so do not be surprised at all to see the outsized moves based upon Netflix, Amazon, Facebook, Microsoft, or Alphabet. That right there would be roughly 33% of the index, and then you have Tesla and Intel right after those, so the cult stocks continue to drive the market higher.

To the downside, the 10,500 level should continue to be massive support, so I would be very surprised at all to see this market break below that level. Even if it does, the 50 day EMA sits just underneath there as well so I still believe that it would be a buying opportunity in that general vicinity. To the upside, I do not have a specific target yet, but I think that 12,000 would be a reasonable gas based upon what we have seen the NASDAQ 100 do as of late. All of that being said though, it is a Non-Farm Payrolls week, so that could come into play.

Furthermore, one thing you should pay attention to is the stimulus nonsense going on in Washington DC. If they can come to some type of terms, then it is likely we will see more bullish pressure as the markets are generally reacting favorably to the idea of more stimulus as they typically do. As long as there is cheap money, then that should continue to propel stocks higher. I have no interest in shorting.