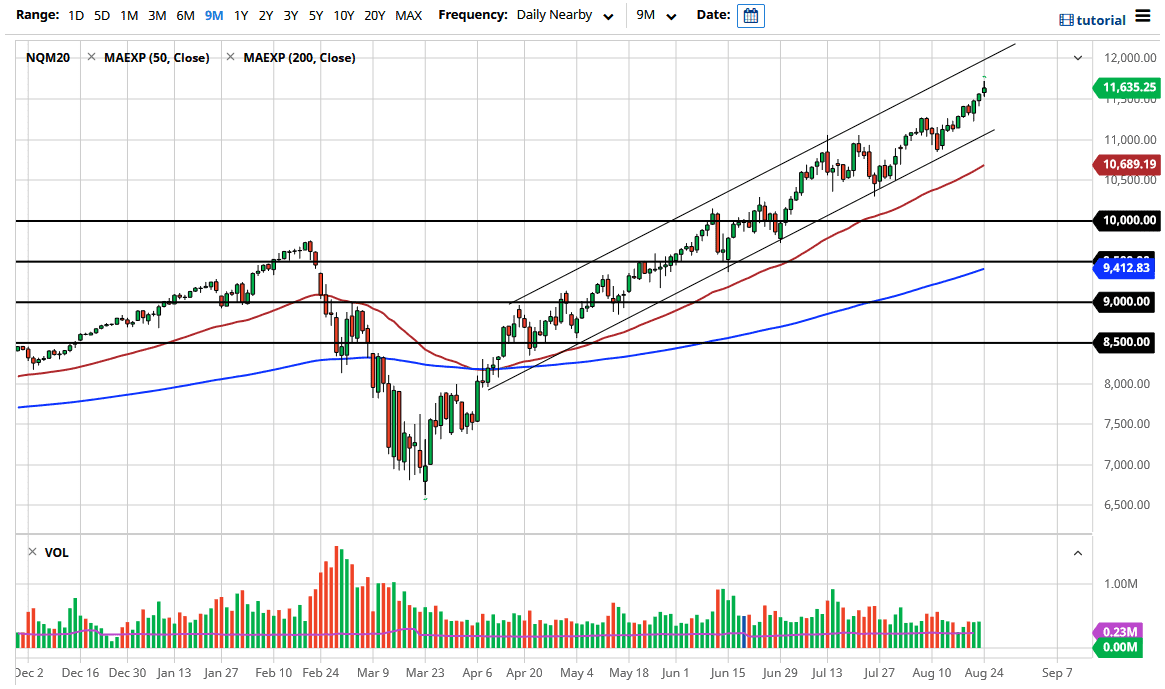

The NASDAQ 100 has gone back and forth during the trading session on Monday, reaching all-time highs yet again. However, late in the day we did see a little bit of a pullback and that may have been profit-taking as we gapped higher to kick off the week. That being said, the market is decidedly above the 11,600 level, so I think a pullback at this point will probably attract a certain amount of attention. Furthermore, I think that the uptrend line of the up trending channel is another place that you should be paying attention to as well. After that, we also have the 11,000 level looking to offer quite a bit of support.

The stock markets of course continue to function on the idea of the Federal Reserve out there willing to step in and protect everybody, and of course Jerome Powell has a speech later this week at Jackson Hole that could come into play as well. Ultimately, I think it is only a matter of time before dips will be bought based upon the idea of “value.” Furthermore, there is a very thin breadth of gainers out there, so I think it is only a matter of time before we get some type of buyers based upon just a handful of stocks. Granted, this normally ends very poorly, but these are all of the same stocks that people will run to, based upon the “lockdown economy”, and just simple habit. These are Facebook, Apple, Alphabet, Netflix, and of course Microsoft. Ultimately, the sample stocks have been driving both the NASDAQ 100 in the S&P 500 higher. There are some other outliers such as Tesla and Intel, but at the end of the day as long as those five stocks rise, so does this index.

To the upside I believe that we will eventually go looking towards the 12,000 handle, which would be an area that would be a large, round, psychologically significant figure that should attract a certain amount of attention. Do not get me wrong, I do not think we get there overnight and I would not be surprised at all to see a little bit of a pullback as the US dollar looks like it is recovering slightly, but later in the week I would fully anticipate the buyers would come back even if we do pull back.