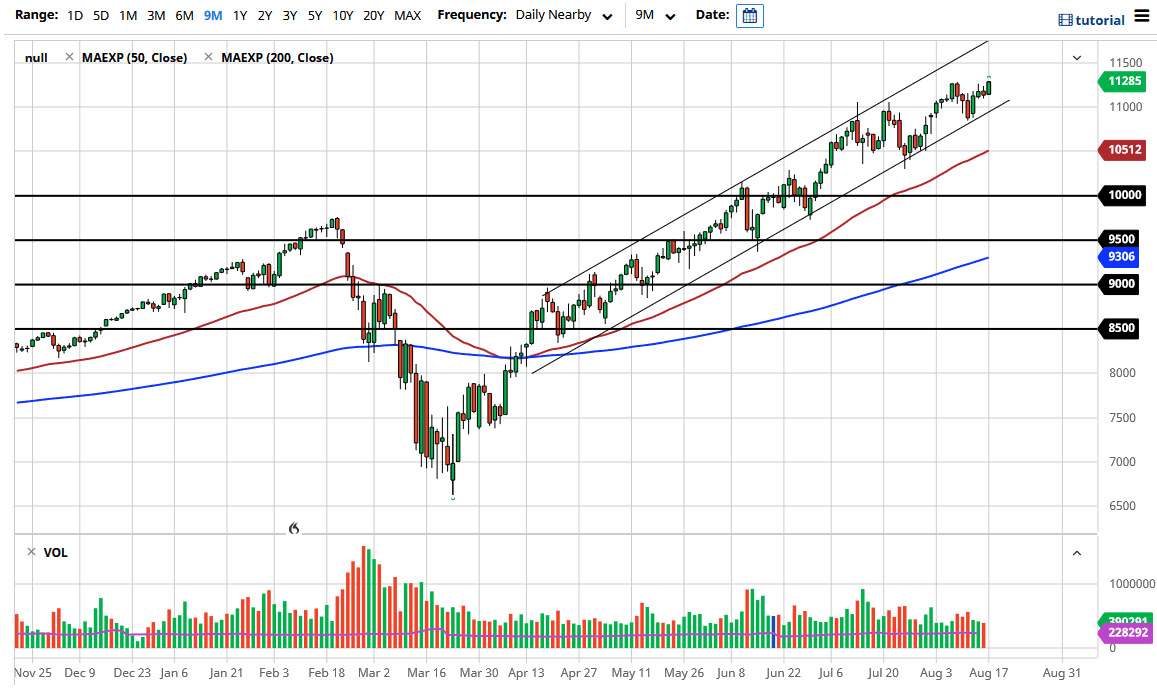

The NASDAQ 100 has broken higher during the trading session on Monday to kick off the week, jumping just above the recent highs. Ultimately, this is a market that I think will find plenty of buyers as the usual suspects continue to be bought, such as Microsoft, Facebook, Alphabet, Tesla, and so on. This is a market that has no reason to continue going higher other than the fact that liquidity is going into the market and the fact that it is not equally weighted. If it were, we would be nowhere near this area as the five most popular stocks comprise 33% of the valuation.

Underneath, there is an uptrend line that has been part of an uptrend in general, and therefore think it is worth paying attention to. The 11,000 level course is a large, round, psychologically significant figure that will continue to attract a certain amount of attention, so I think that pullbacks from here should be buying opportunities. Ultimately, this is a market that you cannot be a seller of, at least not anytime soon.

I anticipate that we will continue to see a lot of money going into this index because quite frankly nobody has any idea what else to do. Furthermore, there is the whole “lockdown trade” that a lot of people are looking into, buying all of the technology companies that make it possible for people to work from home and the like. The candlestick is bullish, and we did close towards the top of the range, so I think it is only a matter of time before we continue to go higher. The next target would be the 11,500 level, which is another round “midcentury mark” that people will be paying attention to. Buying the dips has worked for quite some time and I do not see how that changes anytime soon. If we do break down below the 11,000 level, then it is likely we go looking towards the 10,500 level which is where the 50 day EMA sits. Underneath there, the market is also supported at the psychologically important 10,000 level. All things being equal, think it is only a matter of time before we go much higher as we have for quite some time and it is worth noting that the up-trending channel is a perfect 45° angle.