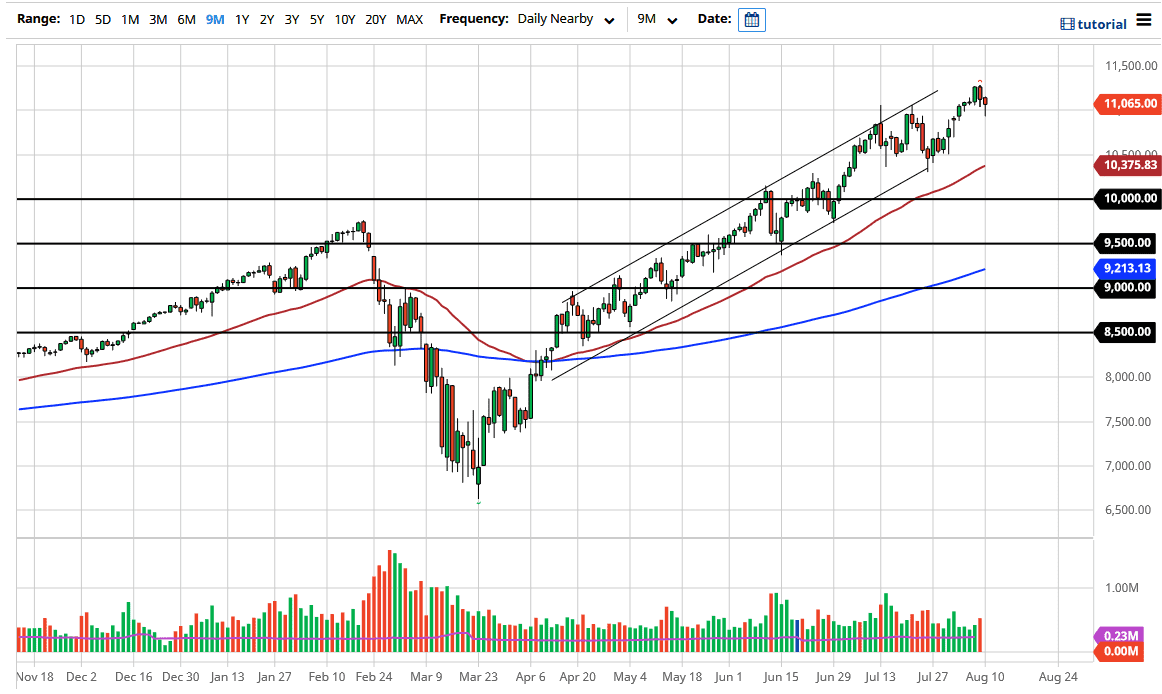

The NASDAQ 100 has broken down significantly during the trading session on Monday to kick off the week but then turned around to show signs of life again. The hammer that formed during the trading session is a very bullish candlestick, and it now looks as if the 11,000 level is trying to hold. Ultimately, if we can break above the 11,000 handle after dipping below, that is a bullish sign. However, a break above the candlestick for the trading session suggests that we are going to go back towards the highs.

The market is currently in a massive up trending channel, so that is something worth paying attention to. I said on Friday that this was a “buy on the dips” market still and it appears that market participants have agreed with me. Ultimately, I think the 10,500 level will be massive support as well, so pay attention to any move towards that area. However, I think we are probably more apt to go sideways than anything else considering just how much damage had originally been done against tech stocks. All things considered, the market was down about 0.6% at the clothes, which is not bad at all concerned it was down 1.5% at the open of the cash market.

Looking at this chart, I think that the market eventually goes looking towards the 11,500 level, and then the 12,000 level. This is a market that is heavily weighted towards all of the favored stocks of everybody out there, including Microsoft, Facebook, Netflix, Alphabet, and Apple. Those stocks alone are roughly 33% of the index, and then you start talking about the stocks just below in the weighting like Tesla and Intel, both popular stocks also. In other words, as long as there is money flooding into the marketplace, this is an index that cannot be shorted. It is only a matter of time before buyers start to pick up those stocks again, and by extension push this market much higher. The 50 day EMA sits just below the 10,500 level and should offer plenty of support as well. In fact, I believe that the bottom of the trend right now is probably down at the 10,000 level, so it is not until we break down below there that I would be even remotely concern, but even then, I probably would not be selling unless something has changed.