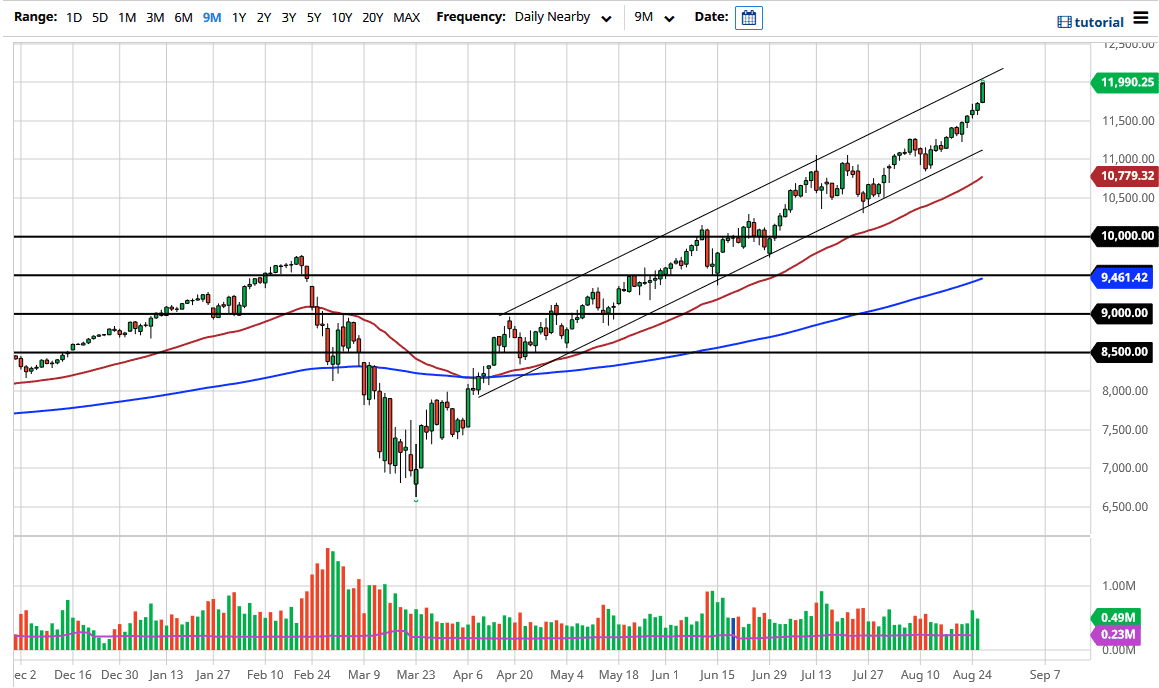

The NASDAQ 100 has exploded to the upside during the trading session on Wednesday, reaching the 12,000 area. We have gotten so far ahead of ourselves it is not even funny, and we are touching not only a large, round, psychologically significant figure, but also the top of an uptrend and channel that has been extraordinarily resilient and reliable for some time. A pullback from this area could make a significant amount of sense, especially as we had gotten a bit ahead of ourselves. That being said, we could continue to see bullish pressure but the quicker we rally, the more likely we are to see some type of nasty pullback.

To the downside, I believe that the 11,500 level should continue to offer support, just as the uptrend line from the channel will. I have no interest in shorting this market, but I am just pointing out the fact that we may get a sudden and violent correction. Regardless, this is a market that I think will continue to see a lot of noisy trading, and of course we will continue to focus on a handful of stocks, which has been the way going forward. I think that given enough time we will eventually see some type of profit-taking but if you are patient enough you should be able to pick up value underneath.

The 11,000 handle of course will be a crucial support level as it is not only near the uptrend line of the channel, but it is also where the 50 day EMA is racing towards. I like the idea of buying pullbacks and would be a bit leery of buying a break above the 12,000 level, although I certainly can see how that would happen. I think at this point we are likely to see volatility more than anything else so because of this we will need to keep your position size rather small. If you have the ability to trade the CFD market, it is probably best to be there instead of the futures market which can rip your face off in either direction if you are not careful. The 12,500 level above could be the next target, but I am very leery about getting overly bullish now, because I think Wall Street has already priced in any good news that Jerome Powell has likely to give us.