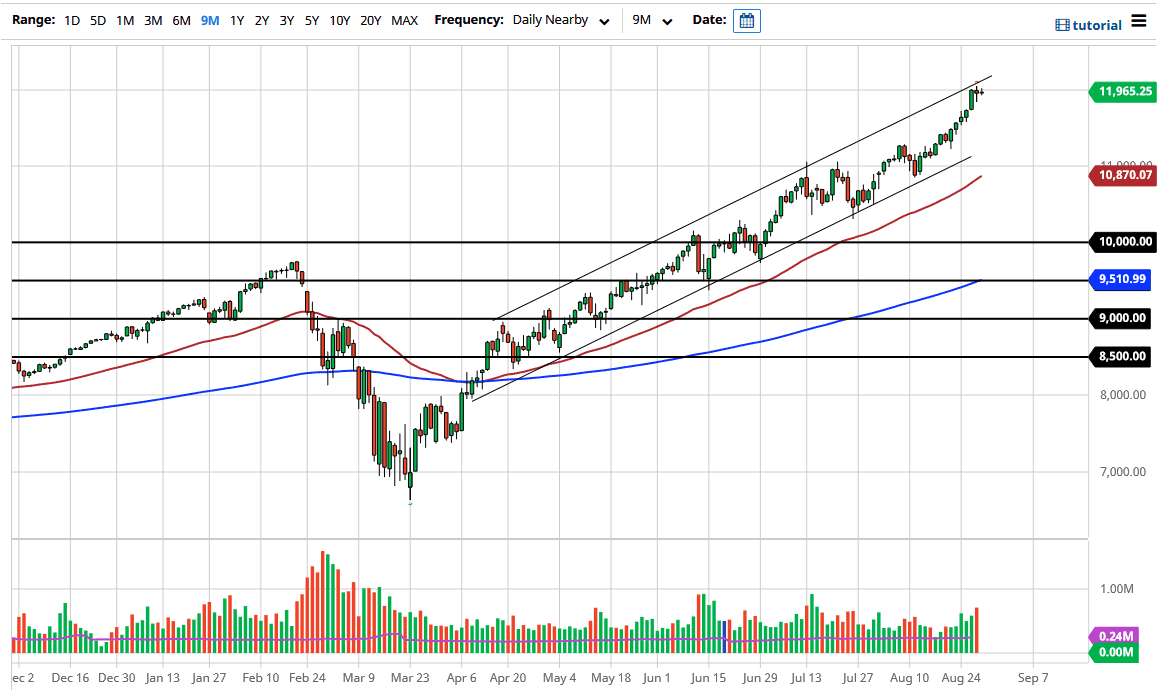

The NASDAQ 100 has gone back and forth during the trading session on Friday as we continue to see a lot of bullish pressure due to the fact that the US dollar is crashing. That has people throwing money into the stock markets, and all of the same stocks are rising as per usual. This includes Netflix, Amazon, Alphabet, Facebook, and Microsoft. As long as those stocks rally, we continue to see this market go much higher. Pullbacks at this point in time should be thought of as buying opportunities and I would like to see some type of pullback.

We are in the midst of a massive up trending channel, and ultimately, we are at the top of it. This means that we could pull back a bit, and that could give you an opportunity. The 11,500 level underneath should be supported, and most certainly the 11,000 level will be. The 50 day EMA continues to offer support as well, as it reaches towards the 11,000 level. The market is getting a little bit extended at this point time, so I fully anticipate that we are going to drop from here.

I have no scenario in which I'm willing to sell this market, and we could see a 10% drop and still remain well within the uptrend. I would love to see that because we are starting to get a bit overdone. That being said, I still would not be a seller and I would love to see three or four red candles in a row in order to find a bit of value, but if we broke above the top of the Thursday candlestick then it means that we will probably enter some type of impulsive run to the upside.

Looking at this chart I can see that we have these impulsive legs previously, and then started to see a bit of a pullback that will only be bought into as clearly the narrative will still say the same as long as the Federal Reserve will do everything it can to prop up Wall Street. That has not changed, so at this point, I think that you have no other opportunity than to pick up little bits and pieces of value as it occurs. A little bit of patience is probably necessary, but in the end, the direction is obvious.