The NASDAQ 100 initially fell during the trading session on Friday, as we had seen a bit of US dollar buying. Having said that, the market is still sensitive to the greenback, and the fact that it rallied a bit caused much of that problem. That being said though, the US dollar has given up some of the gains late in the day and we have turned around to form a fresh, new high again. Ultimately, I think that this market goes much higher and I think we are going to go looking towards the 12,000 level.

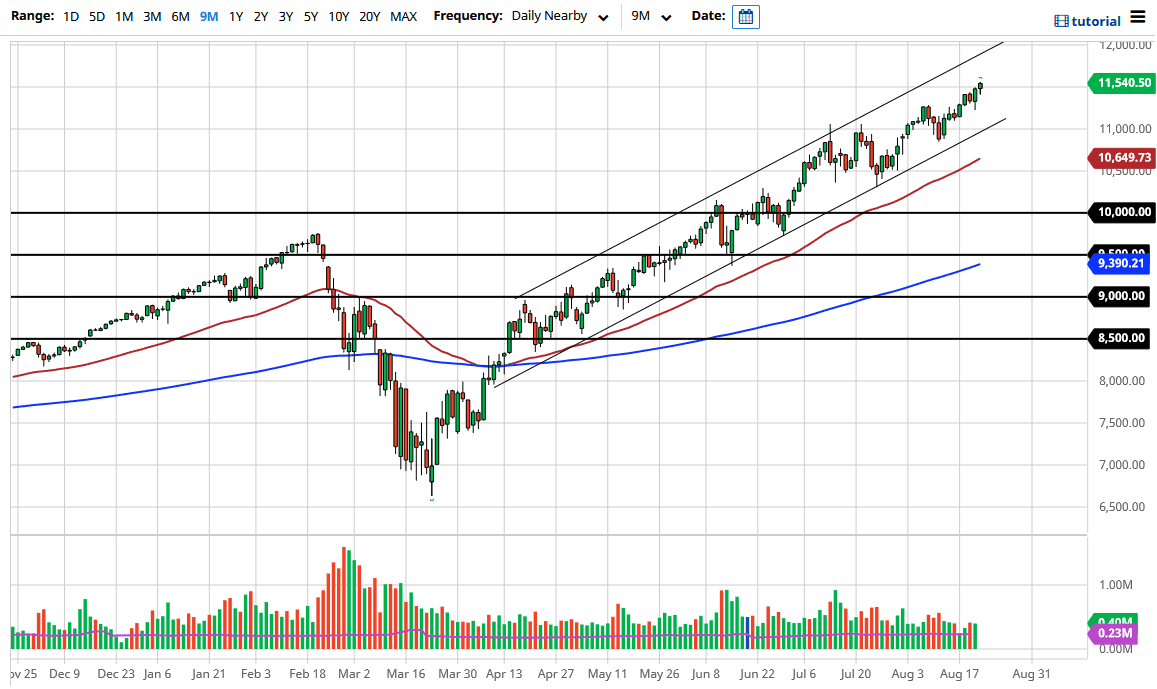

Looking at this chart, we are in an uptrend and channel, and I think that will continue to be the main factor for technical analysis here. Underneath, I believe that the 11,000 level is massively supportive, not only due to the uptrend line, but the fact that it is a large, round, psychologically significant figure, as well as an area that has offered both resistance and support recently. Because of this, I think that the market will look at pullbacks like that as the value in a market that is obviously leading the way for other stock markets.

Keep in mind that the NASDAQ 100 is comprised of basically six stocks at this point in time, maybe seven. Yes, there are other ones but really it comes down to what Microsoft, Alphabet, Amazon, Facebook, Netflix, and Tesla are doing. As long as they are rising in value, the NASDAQ 100 will continue to do the same. The major six players in that being about 33% of the index itself. Ultimately, as long as they arise it is almost impossible for this index the fall. Beyond that, the Federal Reserve continues to flood the markets with liquidity, and that has people looking towards the stock markets in order to preserve wealth. After all, purchasing power will continue to be deteriorating due to what the central banks are doing.

There are no yields when it comes to bonds anymore, so that is yet another reason to keep this market going higher. The main thesis essentially is that the “lockdown economy” continues to favor some of these technology companies that allow people to work from home, telecommute, order online, and the like. Because of this, it is difficult to imagine a scenario where we break down but if we did clear the 11,000 level, I think there is plenty of support all the way down to at least 10,000.