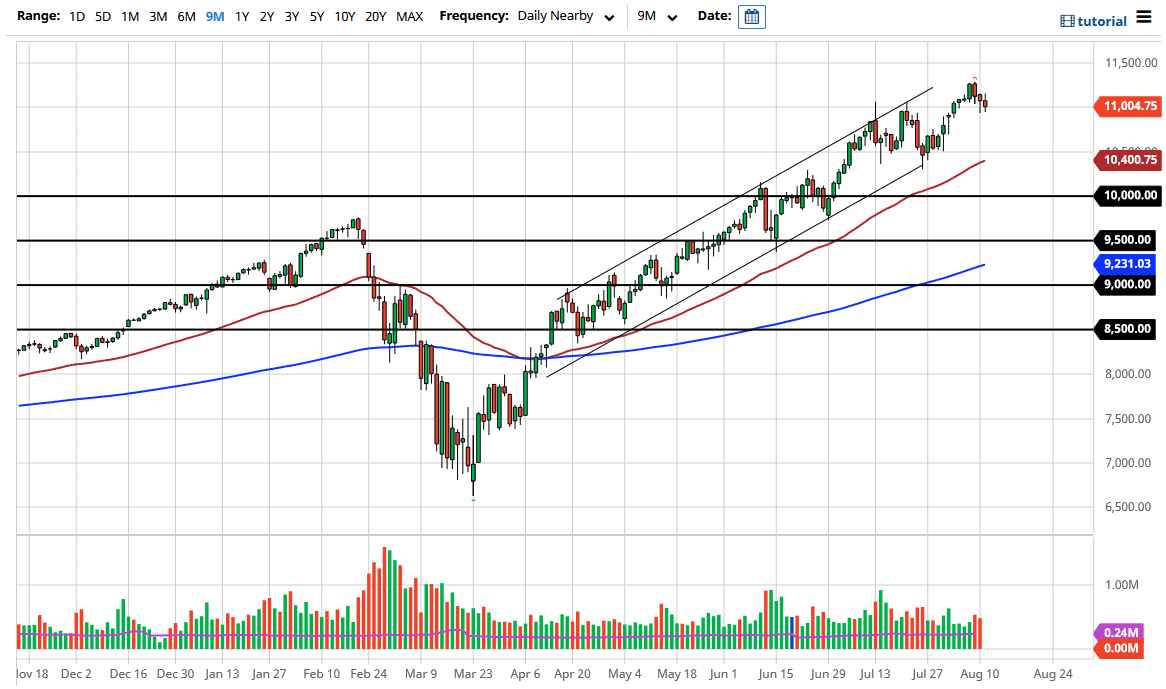

The NASDAQ 100 has initially tried to rally during the trading session on Tuesday but gave back the gains as we dipped below the 11,000 level. That being said, the market looks very likely to see buyers on dips, because the liquidity will keep the market going higher. However, during the trading session on Tuesday, we saw a bit of US dollar buying so that could lead to a little bit of a pullback. Nonetheless, the 10,500 level also offers support, and most clearly the 10,000 level will after that.

Looking at this candlestick, it shows a little bit of neutrality, but the real body is negative, so that tells the trader that the market is likely to be slightly negative more than anything else. At this point in time, I think that buyers will eventually show up so look for value in a market that is obviously very bullish. Furthermore, when you look at the longer-term chart you can see that we are in an uptrend and channel, and that’s something that is worth paying attention to. This market has been bullish for quite some time, and we have recently made an all-time high yet again, so I think it is only a matter of time before we break that one as well.

Keep in mind that the NASDAQ 100 is heavily influenced by a handful of stocks, which of course are all the favorites of Wall Street. This includes Microsoft, Facebook, Alphabet, Netflix, and Apple. That in and of itself is 33% of the index, so as long as people are still buying those stocks, this is an index that will continue to go higher. Ultimately, this is a market that I think will continue to see a lot of buying on the dips, as liquidity measures almost ensure that we will only go higher over the long run. That being said, we are a bit exhausted so do not be surprised to see this pullback at look at it as a value opportunity. Shorting this market is not even a thought for anybody who is looking at big profits. Going back and forth in a channel and buying and selling is ridiculous when you can simply buy with the trend. There is no need to stress yourself out trying to play both sides of the coin here.