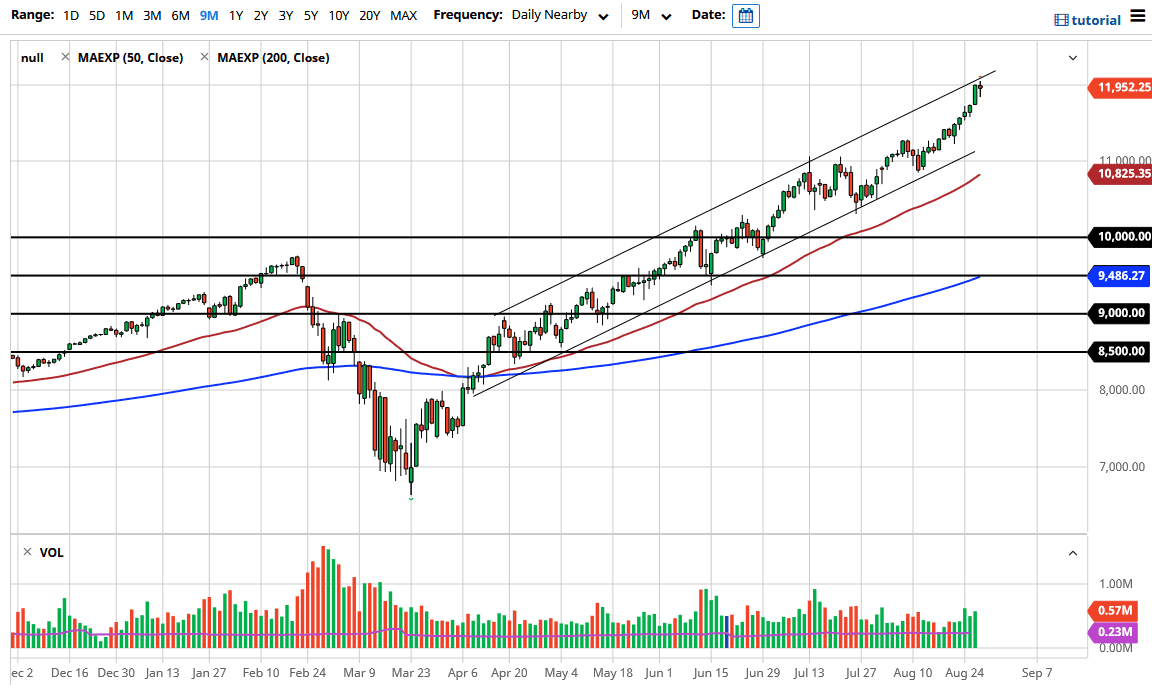

The NASDAQ 100 has gone back and forth during the trading session on Thursday, as we are fighting with the 12,000 level. That is an area that obviously catches a little bit of attention due to the fact that it is a large, round, psychologically significant figure. Perhaps even just as importantly, it is the top of the overall up trending channel, so I think there is the possibility that we see a bit of a pullback from here. The fact that the market ended up forming a bit of a neutral candlestick also gives me the idea that perhaps this is a market that is ready to come back down to earth and recognize gravity again.

To the downside, the 11,500 level would be an area that we could see buyers, and most certainly the 11,000 level would be. I do not even know that we pull back that far, but it is a real possibility. Alternately, if we were to break above the candlestick for the trading session on Thursday, then we will enter a very impulsive leg, which typically ends quite rapidly. This is not to say that you can make money buying that type of move, just that you need to be extraordinarily careful as we are getting a bit over bought at this point.

I would not be surprised at all to see a bit of a pullback heading into the weekend, because most traders will prefer to take profit heading into the weekend, especially with Monday being the last day of the month. Remember, fund managers have to report performance at the end of every month, so quite often they will close out gains to report good numbers to their clients. Even if that was not true, gravity does and will eventually come into play, so that is something that you need to pay attention to. I have no interest in shorting this market, rather I would simply look for some type of value on a pullback that I can take advantage of which makes the most sense considering that the trend is so clear and bullish. The 50 day EMA is rapidly approaching the 11,000 area, so that could become the new “floor” in the market. So far, this up trending channel has been very reliable, so I have to assume that it continues.