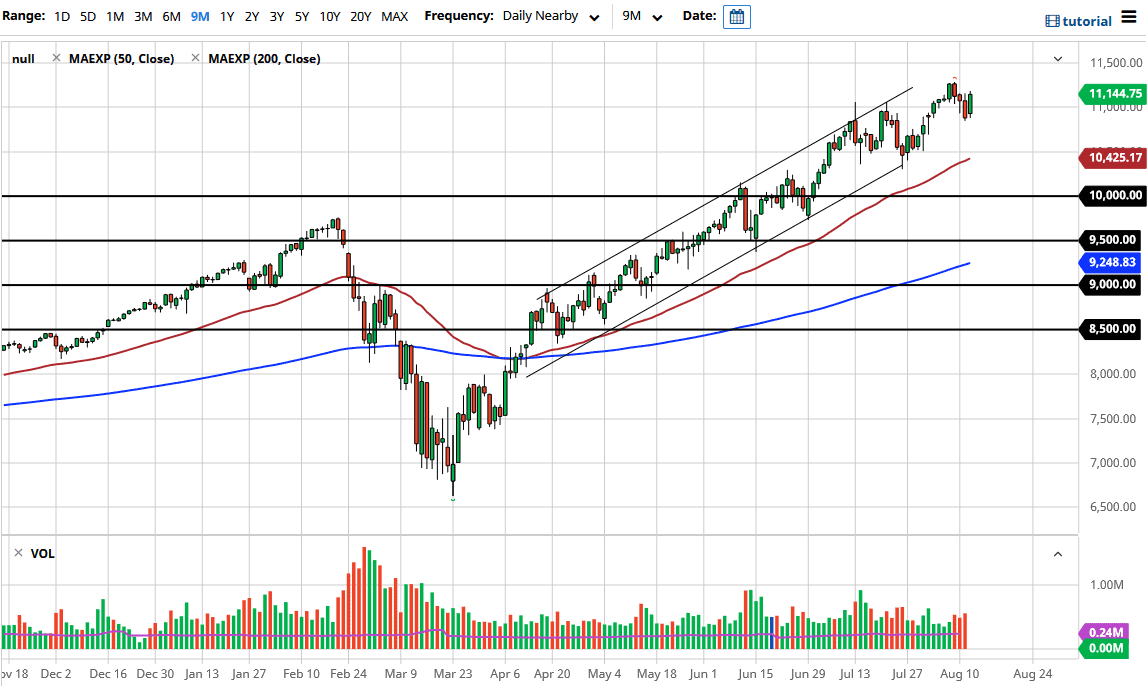

The NASDAQ 100 has rallied rather significantly during the trading session on Wednesday, after gapping to the upside. At this point in time, the market is likely to continue to see a lot of upward pressure, especially after the massive move over the last several months. We are still very much within the channel that we have been looking at for some time, so therefore I do not think much as changed. The fact that we closed towards the top of the candlestick suggests that we continue to see buyers jump into this market. After all, we are not that far from the highs, so, therefore, one would think that traders will continue to eyeball that level.

Beyond that, the S&P 500 is getting close to the all-time highs again as well, so I think that the two markets will move in the same lockstep type of momentum that we have seen in the past. I like buying dips, and the fact that we are clearly above the 11,000 level is something that should not be overlooked as well. The 50 day EMA is closer to the 10,500 level, so at this point, that should be the “floor” in the market. Nonetheless, I do not think we get there anytime soon. Regardless, this is a market that continues to offer buying opportunities on dips, so watching short-term charts might be the best way to go as we continue to see loose monetary policy drive more trading than anything else right now. To think that the markets will have suddenly changed their attitude is a bit of a stretch, regardless of the last couple of days. All things being equal, this is a chopping market with a 45° angle when it comes to a trend.

It is not until we break down below the 10,000 level that I would consider selling and would have to think about the idea of shorting the market. All things being equal though, this is a market that I think has plenty of reasons to go higher, not the least of which is that Wall Street does not know any better. Yes, the economy has nothing to do with what is going on, but since you already know that there is no reason to fight the overall trend. You can be “correct”, or you can be profitable, this market is essentially that simple.