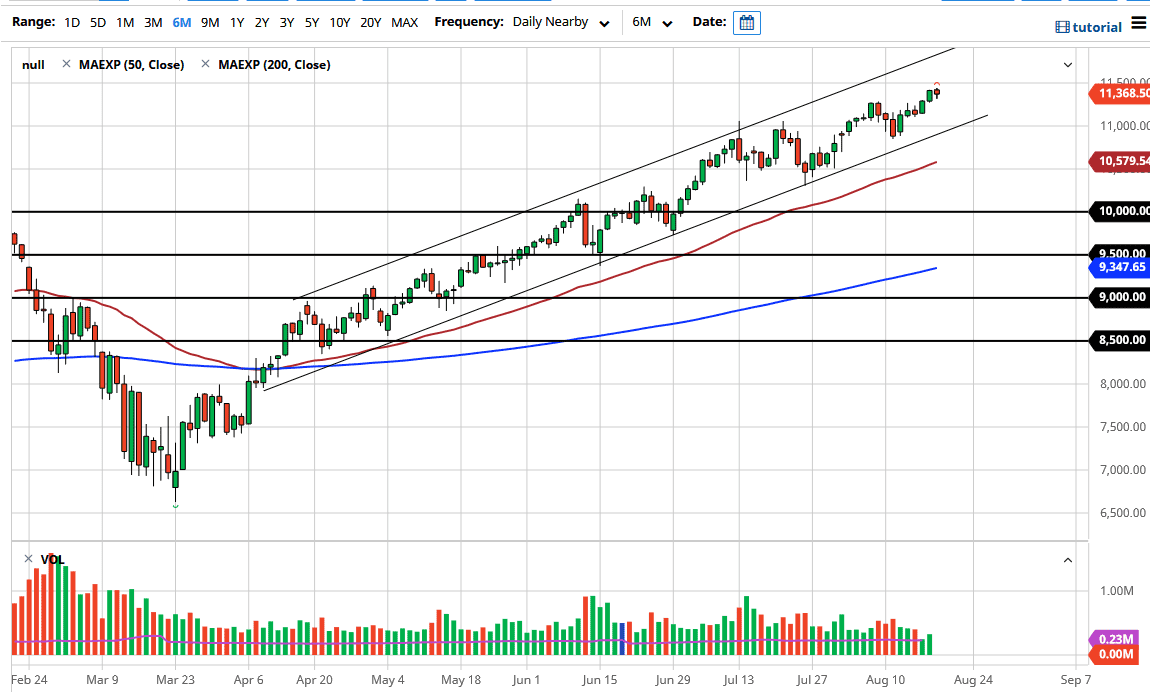

The NASDAQ 100 has pulled back just a little bit during the trading session on Wednesday, but there is not much out there to be concerned about right now, at least not anything more than we had previously worried about. That being said, we are a little bit extended so it makes a bit of sense that we would be looking at a potential pullback. Just above, we have the 11,500 level that could offer a bit of a barrier.

To the downside, the 11,000 level looks to be rather supportive as it is not only the scene of the most recent bounce, but it is also a large, round, psychologically significant figure. Furthermore, we have the uptrend line of the channel sitting right there as well, so I think there are plenty of reasons to think that there would be buyers down there waiting. Underneath, the 50 day EMA is currently sitting at the 10,600 region, so that also offers support. Furthermore, I believe that the 10,000 level should offer plenty of support from a psychological standpoint. In fact, it is not until we get underneath there that I would be a seller of this market because it has been so bullish.

As long as the Federal Reserve is out there flooding the market with currency, people will be buying assets in order to get away from currency depreciation. The central banks around the world are all doing the same thing, that is why we are seeing gold and stocks rise at the same time. Having said that, the US dollar did rally a bit during the day so that might have had something to do with the market pulling back as it has, but we had a couple of green days in a row, so a short-term pullback should not be thought of as a major concern. To the upside, I believe that the market is eventually going to break above the 11,500 level, and then go looking towards the 12,000 level. We are in a nice up trending channel at a reasonable angle. This is everything that you want to see in an uptrend, so there is no point in fighting it. Granted, the index is driven by a handful of stocks, but that has been the case for some time.