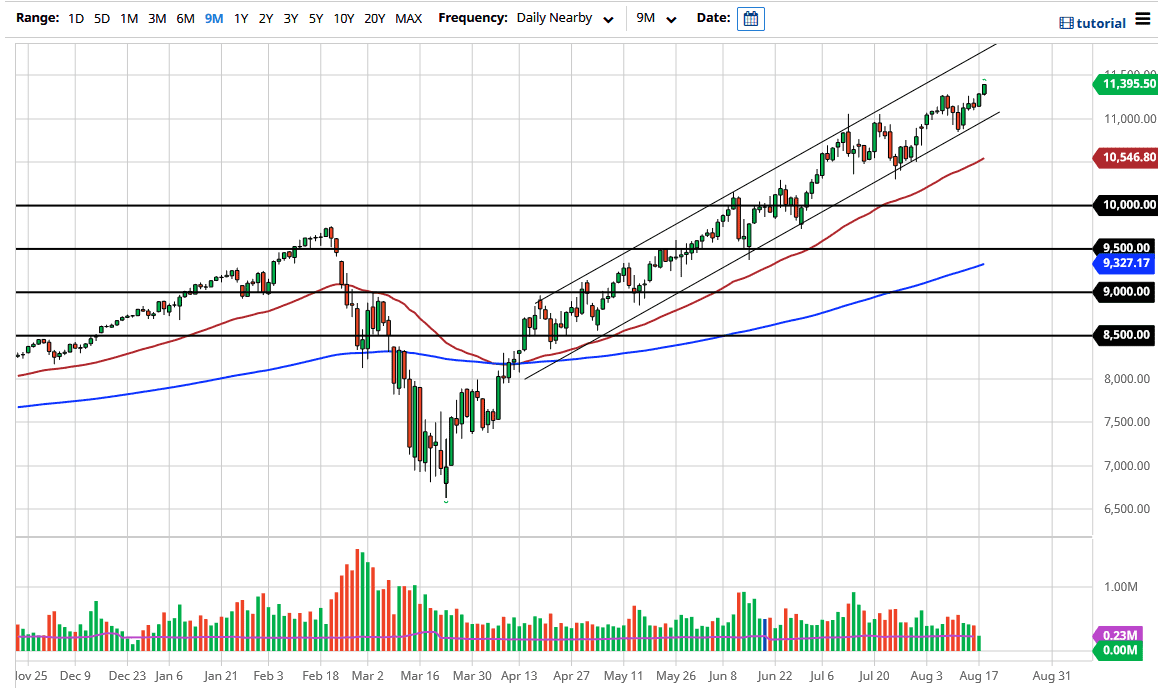

The NASDAQ 100 has rallied a bit during the trading session on Tuesday again, breaking out to a fresh, new high. Ultimately, this is a market that has plenty of buyers underneath and I think it is only a matter of time before we get the “buy on the dips” mentality jumping in and taking advantage of the strong trend. We have been in a nice up trending channel for some time, and therefore I think we still see plenty of technical traders out there looking to pick up dips.

Currently, the 11,000 level is sitting near the uptrend line from the up-trending channel, so I think that is an excellent place to see buyers jump in. Underneath there, we have the 50 day EMA sitting roughly at the 10,550 level, so I think that is also an area where there would-be buyers. All things being equal, I have noticed shorting in this market, because it has been so strong for so long. As money flows into the markets, traders look for ways to preserve wealth, as the currency is being devalued. Furthermore, this is driven by a handful of major stocks out there that benefit from the overall “lockdown culture” that the economy finds itself in right now. This means companies like Facebook, Alphabet, Netflix, etc. are being bought left and right. As long as that is the case, that will send NASDAQ 100 higher.

Obviously, there is no way to short this market, because selling this market is against everything that structure and fundamental analysis tells us. Granted, I recognize that stock markets are rallying while the economy is struggling, but you need to keep in mind that the market does not represent the economy and it should not be mistaken as a reflection of it. After all, the liquidity alone will keep stock markets going higher than any type of growth. The idea that profit matters is something that has gone by the wayside for well over a decade, so now it is all about what the Federal Reserve is doing. Now having said that it is likely that we will continue to see more of the same. Ultimately, there is no way to short this market anytime soon, as long as we can stay above the 10,000 level. If we were to break down below there, then at that point I would have to reevaluate the entire situation.