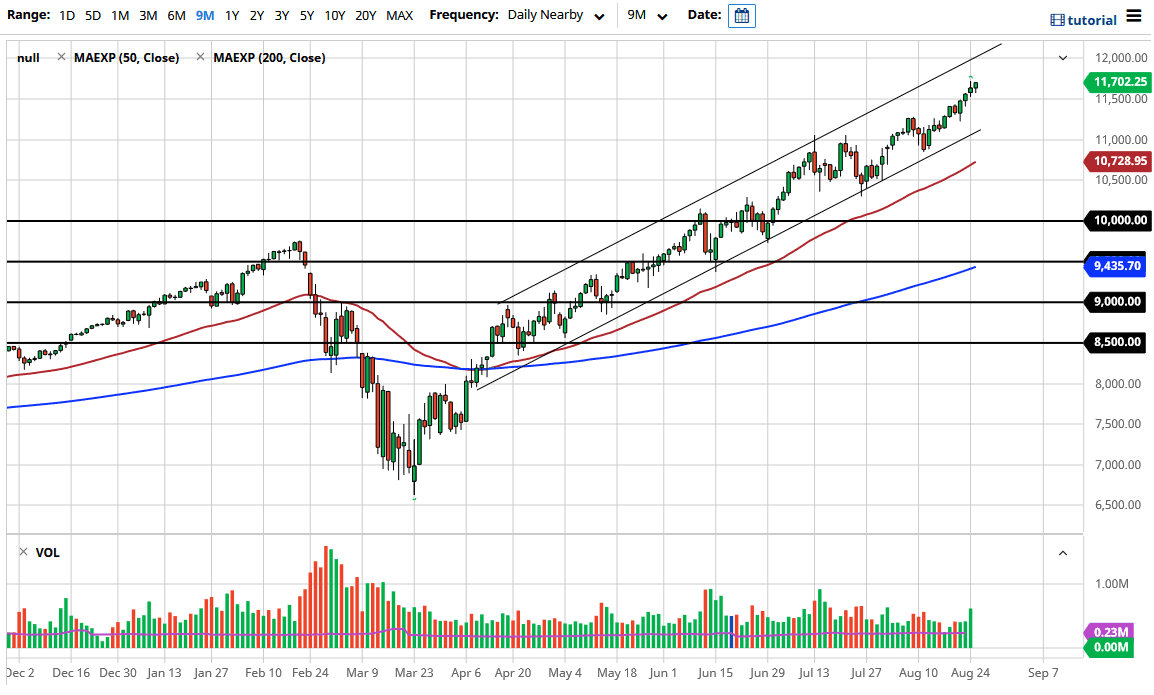

The NASDAQ 100 has initially pulled back a bit during the trading session but then turned around to show signs of strength yet again on Tuesday. At this point, it is all about the Federal Reserve more than anything else, so at this point, I think it is simply a “buy the dips” type of scenario, and therefore the 11,500 level should offer plenty of support as it is a psychologically important figure and had been previously short-term resistant. Ultimately, this is a market that I think eventually will find plenty of buyers and therefore I think this is a scenario that you cannot short this market, simply because the momentum is so strong. The Federal Reserve is going to continue to see the need to loosen monetary policy, thereby showing a likelihood of currency devaluation, so people will be buying “things” in order to protect wealth.

To the downside, I believe that the 11,000 level will be rather supportive because it is not only just below the uptrend line on the up-trending channel, but it is also a large, round, psychologically significant figure. If we do pull back to that area, it will be an area that has a lot of interest, and therefore would probably be a great area to start buying again. That being said, I do not expect to see 11,000 printed anytime soon.

To the upside, we are probably going to go looking towards the 12,000 level, but I think we may need the occasional short-term pullback in order to build up the necessary momentum. It is also the top of the overall uptrend channel, so it would make sense that we would see a little bit of resistance up in that region. If we were to break above the top of that level, then it would potentially be a bit of a “blow-off top”, assuming that we get there rather quickly. If we grind back and forth, then it is likely that the move will be a bit more sustainable. Remember, this is an index that is not equally weighted, so it is all about the usual five or six stocks as far as whether or not we go higher, which includes Facebook, Microsoft, Netflix, Alphabet, and Amazon.