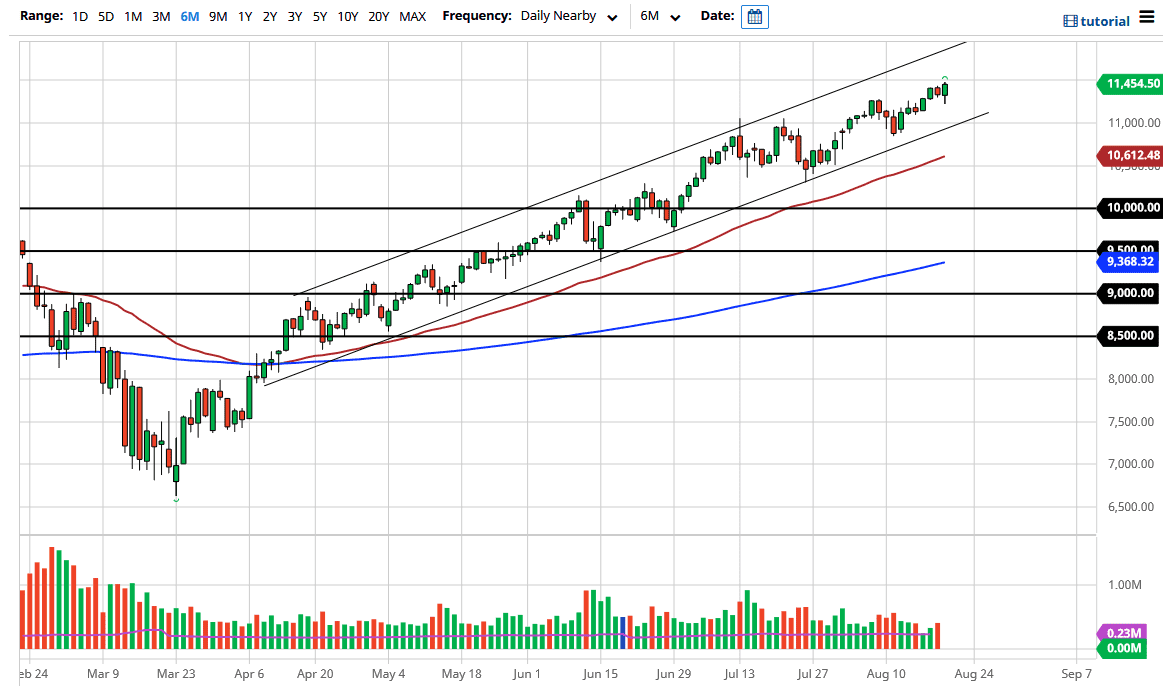

The NASDAQ 100 initially fell during the trading session on Thursday, but then turned around to show signs of life again. Ultimately, this is a market that has turned around to break to an all-time high again, and as I record this at the very end of the session, we are threatening the 11,500 level. That is an area that will attract a certain amount of attention due to the fact that it is a midcentury figure, but ultimately, I think we have a scenario where it will simply be a blip on the radar.

We have been in a nice uptrend for some time, and now that we are in the midst of the massive ascending channel, to me this is a market that looks ready to lead the way. Remember, it is just a handful of stocks that matter anymore, and most of those are at the top of the NASDAQ 100. The usual suspects such as Netflix, Facebook, Amazon, Alphabet, and Microsoft will continue to drive this market higher as people bet on the “lockdown” economy. It is an obviously overcrowded trade but until the bubble gets burst, you cannot bet against it. Ultimately, buy the dip has worked multiple times and I do not see any reason why will not here.

The up trending channel has a significant uptrend line that is slicing through the 11,000 level currently, and I think it is only a matter of time before traders would find value or at least a reason to go long in that general vicinity. I do not see anything stopping this market from going to 12,000 in its current state, as liquidity is the only thing that matters, right along with those handful of stocks. Even if we did break down below the bottom of the channel, I believe that the 10,500 level offer support, assuming that we can even get through the 50 day EMA. In fact, it is not until we break down below the 10,000 level that I even begin to question the overall upward momentum of this market. The NASDAQ 100 has been an absolute beast for months, and every time it looks like it is getting a little bit heavy, plenty of value hunters come back in and pick it up yet again.