The NASDAQ 100 initially gapped higher during the trading session on Friday, but then fell like a rock earlier in the day. That being said, everything turned around and showed signs of strength again, as the same stocks that have been pushing the NASDAQ higher for ages now continue to support everything. Now that we have the major technology companies out of the way as far as earnings are concerned, NASDAQ 100 traders can get back to the “buy on the dips” type of mentality. When you look at the NASDAQ 100, there are only a handful of companies that matter, so if Amazon, Alphabet, Microsoft, Facebook, and Netflix continue to show signs of strength, then it is almost impossible for this index to drop.

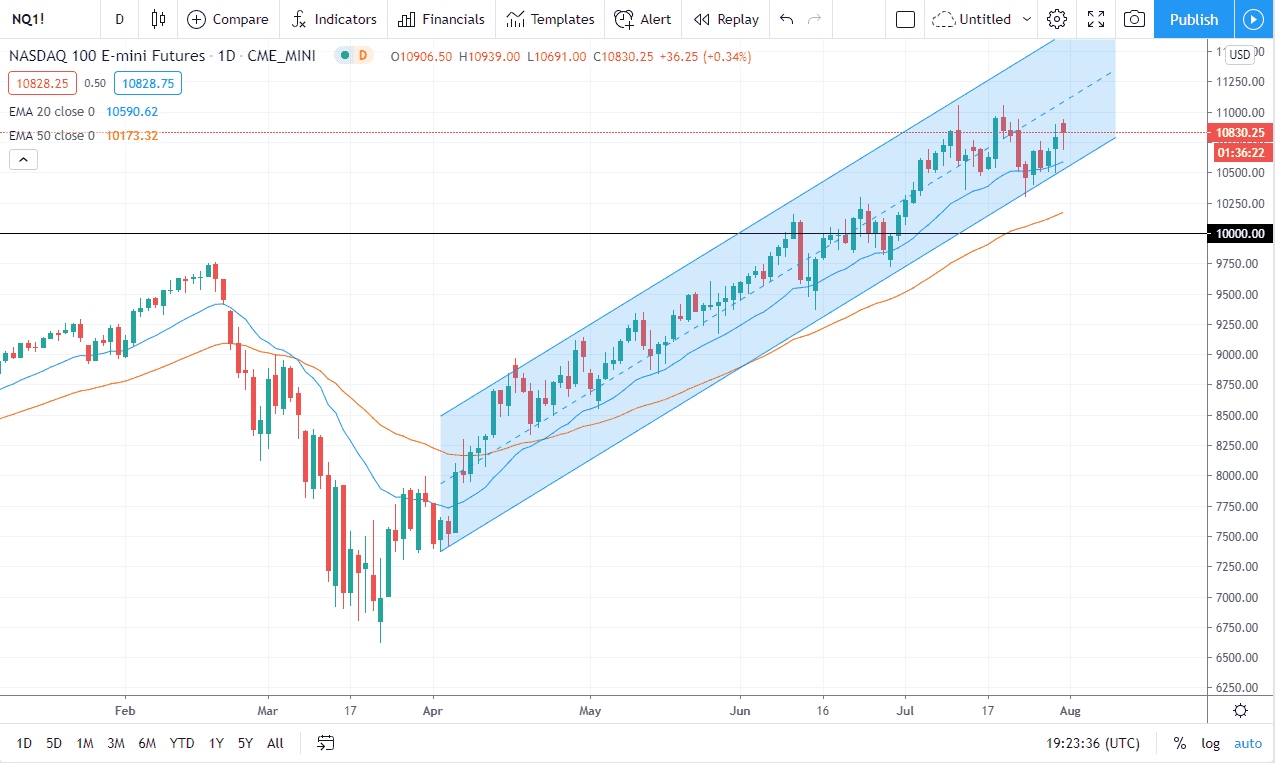

What is worth paying attention to is the fact that we formed a hammer during the previous session, and then another hammer during the day on Friday. With that being the case, it is likely that we continue to see a lot of value hunters coming into the marketplace every time it dips, and it looks like we are going to go looking towards the 11,000 level. The 11,000 level continues to be a target in general, and therefore I think it is only a matter of time before the market gets there. If we can break above there, then it is likely we go looking towards the 11,500 level.

Even if we break down below the 10,500 level, it is likely that there is plenty of support at the 50 day EMA which is closer to the 10,250 level, and that of course the large round figure at the 10,000 level. It is not until we break down below 10,000 that I would be concerned about the uptrend and step out of the way to let things settle down before start buying again. The NASDAQ 100 has enjoyed a massive run due to the fact that it is supported by the same stocks that everybody buys, and that is going to continue to be the case as a lot of the technology companies have benefited from the idea of the “stay-at-home economy”, and therefore the same trade that has been pushing the market along for some time should continue to be the way going forward. I have no interest in shorting anytime soon.