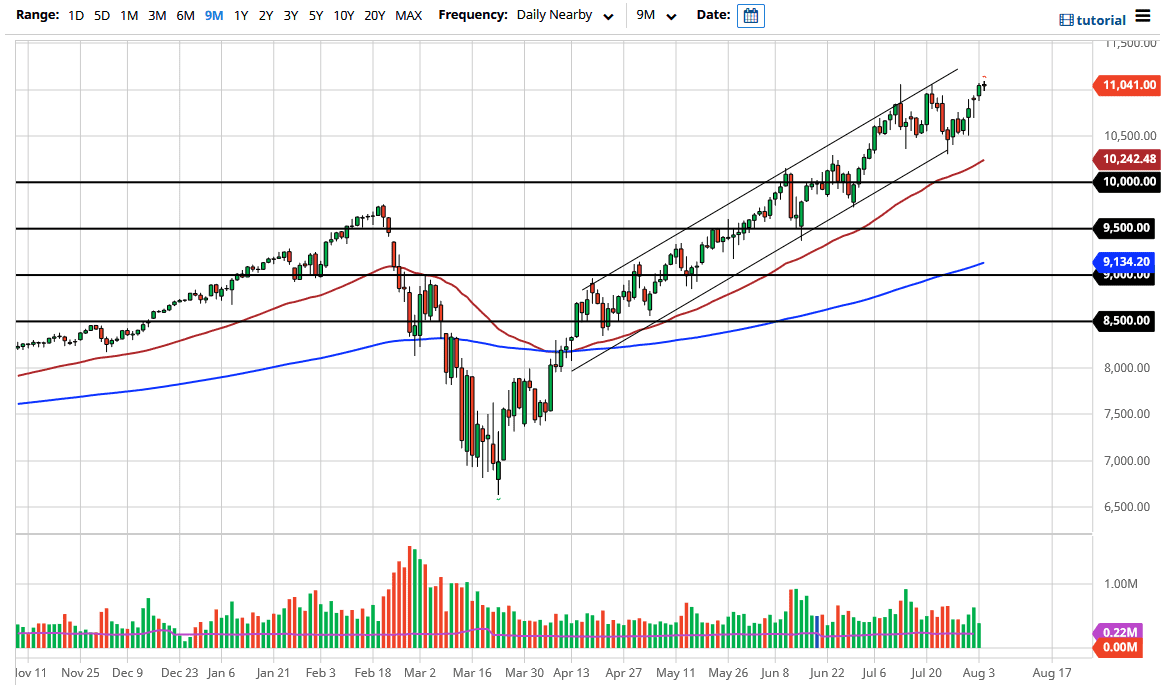

The NASDAQ 100 has done very little during the trading session on Tuesday, as we have cleared the 11,000 level. The market is likely to continue grinding higher given enough time, but I think at this point we are apt to see some type of pullback. We are still very much in the channel that has been shooting this market higher, so I think it is only a matter of time before the NASDAQ 100 will find buyers on dips. The last couple of days have been relatively strong, offering a bit of a pullback only to see signs of strength again.

The 10,500 level underneath has massive support, not only due to the large, round, psychologically important significant figure but the fact that the uptrend line of the channel crosses right through that level. Ultimately, this is a market that sees a lot of noise in general, and therefore I think pullbacks will be thought of as buying opportunities. Furthermore, just underneath the 10,500 level as the 50 day EMA and it is likely it will offer support. After that, we then have the 10,000 level which is also an area that is going to attract a lot of attention.

With all that being said, we are very much in an uptrend and we need to keep that in mind. Selling the NASDAQ 100 is akin to throwing money away. Remember, there is just a handful of stocks that are pushing this market higher, and that should continue to be the way things are going forward. All things being equal, this choppy behavior should continue, and you should be looking for value as it occurs. I believe that there will be plenty of opportunities to go long of this market going forward, as we go marching towards the 11,500 level, possibly even the 12,000 level. It is not until we break down below the 10,000 level that I would consider selling, and I am not exactly sure what would cause that as the Federal Reserve continues to pump cash into the marketplace and down the throats of anything related to assets. People are buying stocks due to the fact that the currencies that they own are being devalued on a daily basis. With this, people are starting to buy “things”, including the same stocks that have been driving the NASDAQ 100 higher for ages.