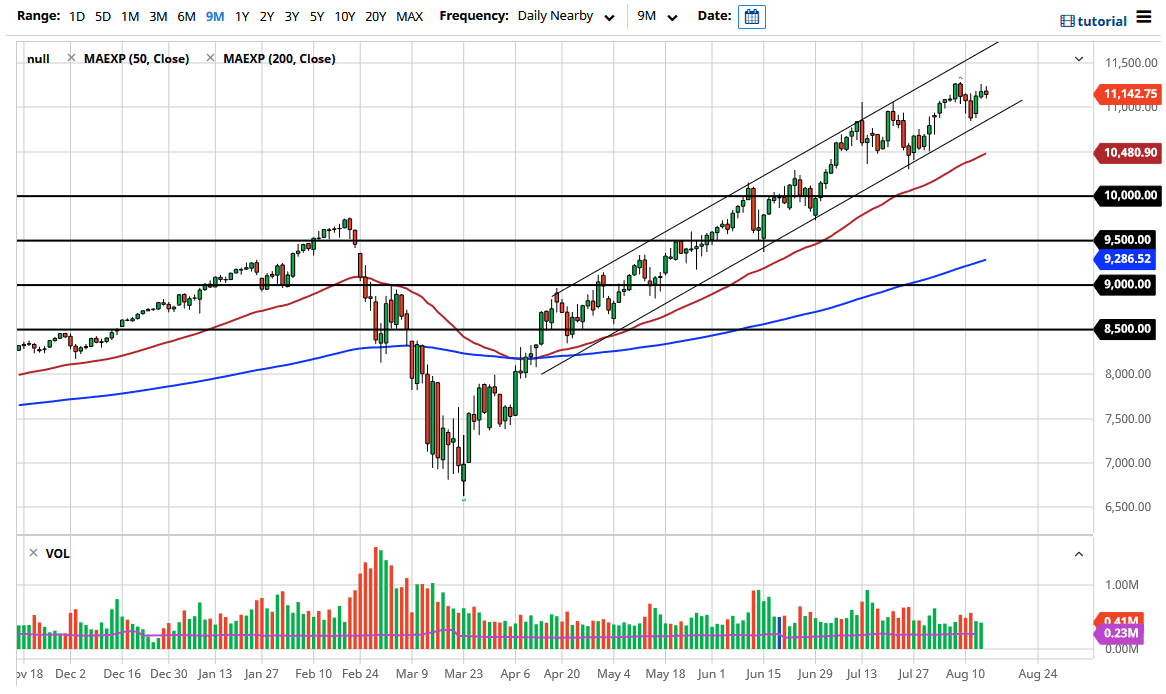

The NASDAQ 100 has gone sideways again during the day on Friday, as we are near the 11,150 level. At this point in time, the market should see plenty of support in the neighborhood of the 11,000 level, which is a large, round, psychologically significant figure. Overall, we are in a major up trending channel, and unless we break down below there it is likely that we will continue to go much higher.

The NASDAQ 100 continues to be one of the favored indices around the world, and therefore it is likely that we will see buyers enter this market when we get more of a “risk-on” type of attitude. Looking at this chart, I think there is support all the way down to at least the 10,000 level, with multiple stops between here and there. The NASDAQ 100 continues to be driven by a handful of stocks, including Microsoft, Facebook, Alphabet, Amazon, and Apple. Ultimately, this is a market that is driven by just a handful of stocks.

Looking at the candlestick for the Thursday and Friday sessions, you can see that we have gone nowhere for the last couple of days. Ultimately, there seems to be a bit of hesitation as both the NASDAQ 100 and the S&P 500 are approaching all-time highs, which causes a little bit of hesitation in general. The market has psychological resistance above but there is nothing to actually stop the market from going higher. With this, I think it is only a matter of time before the markets will find more continuation based upon people trying to figure out what to do next, as the devalued US dollar buys less and less, and therefore it is ultimately a way to protect wealth. The 11,500 level is my short-term target, but we need to break to a fresh, new high. I have no interest in shorting until we get well below the 10,000 level, and even then, I need to evaluate the overall situation. Right now, it does not line up fundamentally to be sure because we have survived earnings season yet again you and therefore that was the biggest risk for the time being.