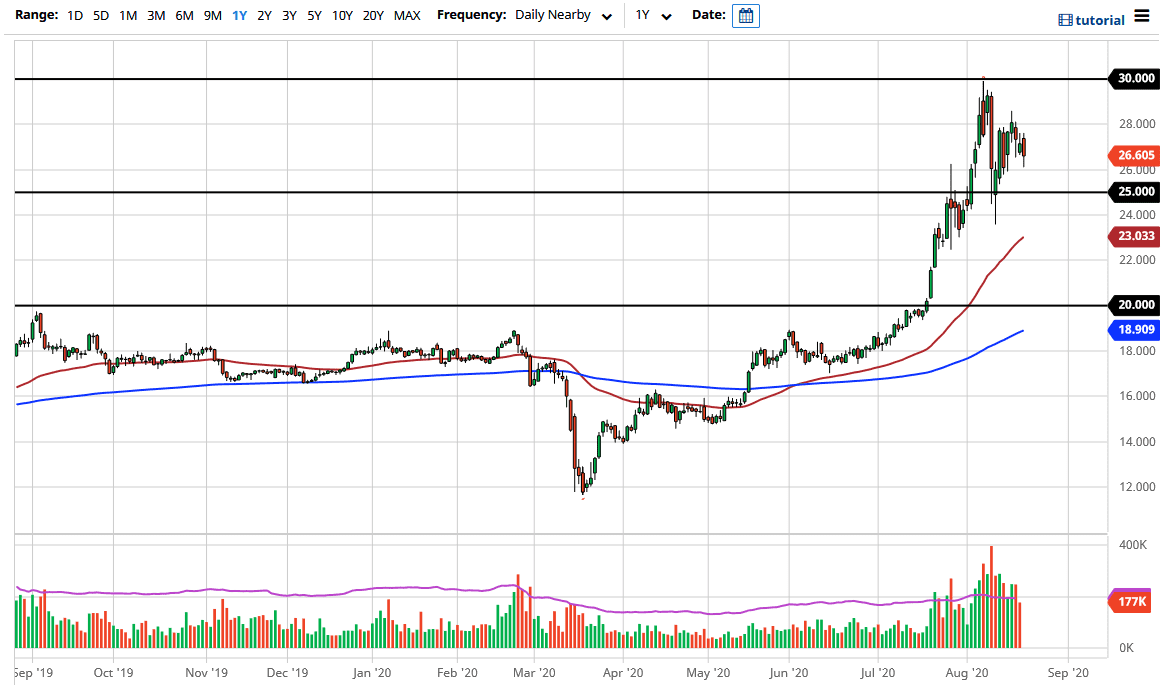

The US dollar has rallied a bit during the trading session on Friday, and this put a bit of negativity into the silver markets. Ultimately, when you look at the chart, we have reached down towards the $26 level, the beginning of significant support all the way down to the $25 level. There is a significant amount of support in that general vicinity from not only structural trading but from the fact that it is a large, round, psychologically significant figure.

The $28 level above has offered resistance, so if we can break above there then the $30 level would be the next target. All things being equal, when you look at the chart it looks as if it is somewhat forming a triangle, as we are trying to figure out what to do next. The silver market is reacting to the US dollar, which is sitting on massive support on the US Dollar Index, and therefore it is interesting to see will how this is going to play out. If the US dollar does in fact recovers, then it is likely that we are going to see silver fall. However, if we see more selling in the US dollar, then it is very likely that silver takes out to the upside. Regardless, it does make sense that we did get a little bit of a pullback here, due to the fact that we had shot straight up in the air and the US dollar had been far too oversold.

Central banks around the world continue to liquefy the markets, and therefore it makes quite a bit of sense that the precious metals markets will continue to go higher. The longer-term outlook for precious metals is most certainly bullish, but silver has gotten far too ahead of itself. In fact, we could pull all the way back to the $20 level which would be a massive support level, as it was a major breakout to the upside. Ultimately, that would simply be retesting that area, which is something that happens quite a bit. That would also offer a significant amount of value that a lot of people would be paying attention to, but it would obviously take a significant move to make that happen. I think we are much more likely to see buyers coming back in closer to the $25 level.