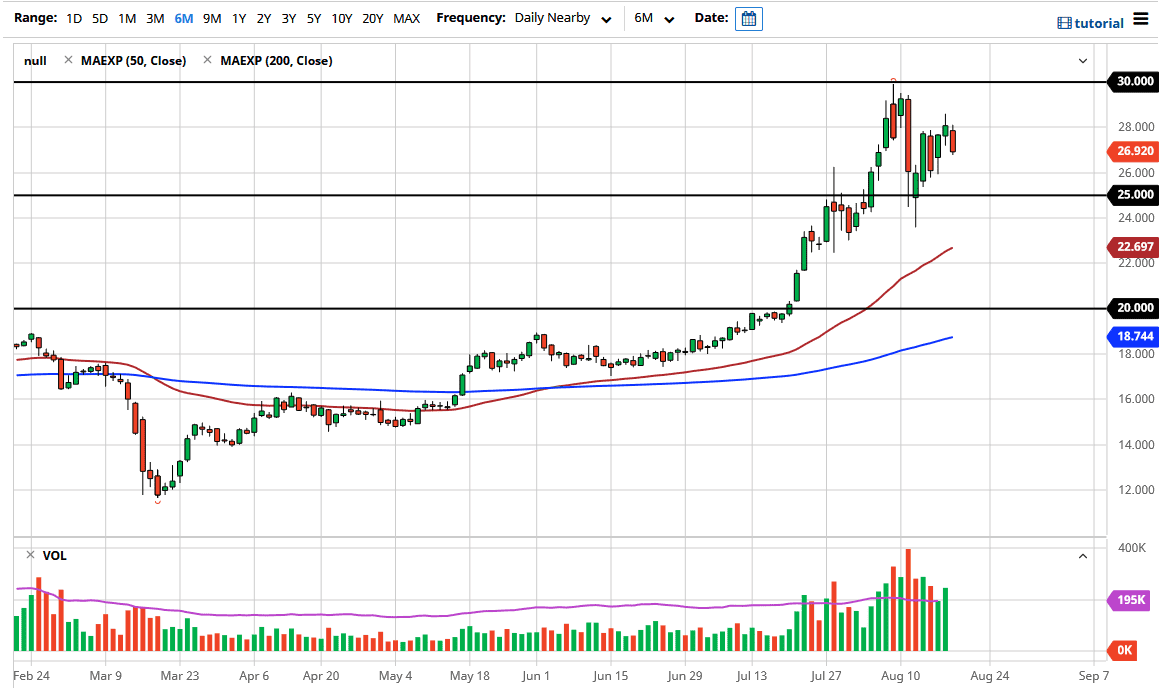

The silver markets have pulled back significantly during the trading session on Wednesday, after a nice recovery from the massive selloff that had happened last week. At this point, we are closing out the day at the bottom of the range, so it suggests that we are going to continue to drift a little bit lower. The US dollar has been oversold and the US Dollar Index looks likely to bounce from here. If that is going to be the case, then it is likely that the precious metals markets may suffer a bit.

Underneath, the market will have a significant amount of support below, probably starting at the $26 level and most certainly showing itself at the $25 level, which of course is a large, round, psychologically significant figure. At this point, I would anticipate a lot of people looking to get involved in the trade that we had recently seen. Having said that, if we break down below that area then we need to look at the real possibility that we just made a “lower high” in the market. However, I think really at this point it is just a matter of the US dollar being so oversold that we needed to recover a bit. I think that we are still early in the precious metals cycle, so the pullback should still be looked at as a potential buying opportunity.

The 50 day EMA is currently at the $22.69 level and reaching towards the $24 level. The market will continue to be very noisy, but one thing that you should pay attention to is the fact that we are in the midst of vacation season. Because of this, it could be a bit choppy and sideways more than anything else but longer-term I still think that the Federal Reserve flooding the market with liquidity will continue to drive precious metals higher, as well as the rest of the commodity markets themselves. I recognize that the $30 level above is a major target, and if we can break above there then we can really start to pick up momentum, perhaps reaching towards the $50 level. All things being equal, I am a buyer of dips, but we may have a day or two of stability ahead of us before we can start buying an impulsive move to the upside. If we break above the highs of the day though, that would be enough for me to start buying again.