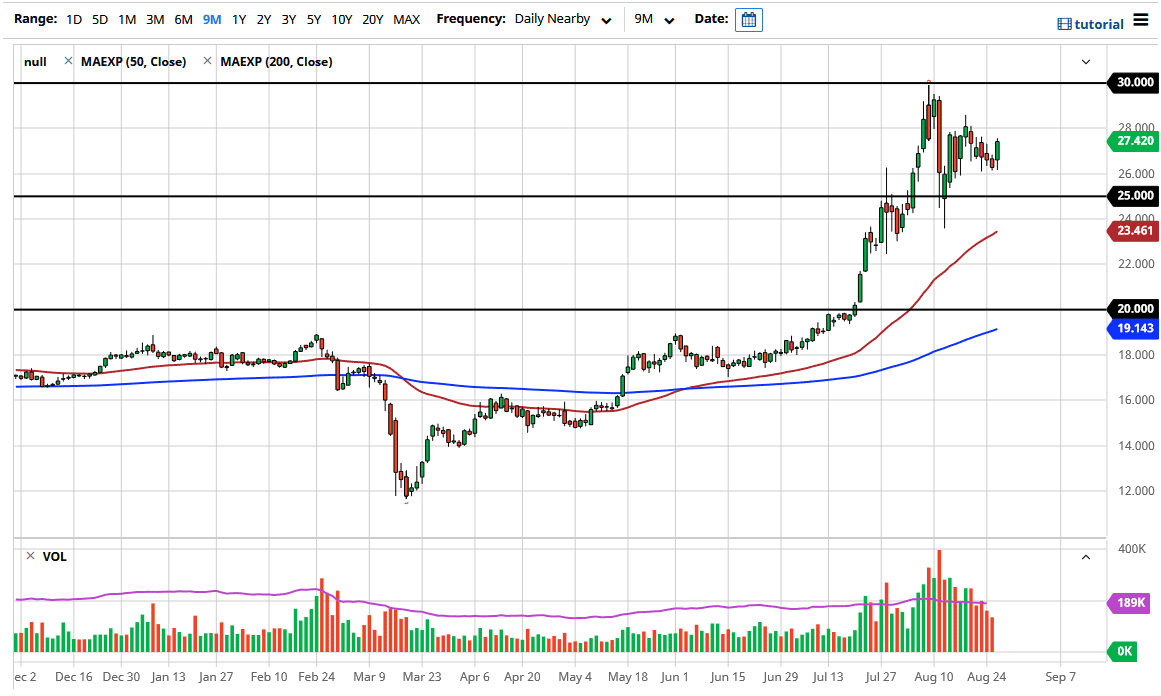

Silver markets have rallied quite nicely during the trading session on Wednesday after initially dipping. The $26 level looks as if it has offered a significant amount of support, and therefore it makes quite a bit of sense that we could go looking towards the $28 level as we have broken clearly above the $27 level. This is a market that I think continues to see you looking at a market that continues to go marching towards the $28 level, and perhaps possibly even the $30 level over the longer term.

With Jerome Powell speaking during the trading session on Thursday, it is likely that we will get a bit of a move in the US dollar given enough time. Ultimately, this is a market that is going to react towards the value of the US dollar, because it does tend to move in the opposite direction. The US dollar took a bit of a bashing during the trading session on Wednesday as people are starting to bet on the Chairman saying something dovish when it comes to the monetary policy coming out of the Federal Reserve, and that of course will drive down the value of the greenback. If that is the case, then it will take more of this greenbacks to buy silver.

Breaking above the $28 level will be a major breakout, but the $30 level above will continue to be the real prize. If we can overcome that then it is likely that the market continues to go much higher, possibly the $50 level could even be targeted based upon previous blowoff rallies that we have seen in the past.

On the other hand, if we pull back from here, I think there should be plenty of support near the $25 level, which of course is a large, round, psychologically significant figure. Underneath there, we would be looking at a potential support level in the form of the $24 level, especially as the 50 day EMA is approaching that same level as well. Ultimately, this is a market where we will continue to see a lot of volatility, but I think there is more than an of buying pressure underneath to continue to drive silver much higher. As long as the US dollar continues to drop, this continues to be one of the bigger performers right along with the gold markets.