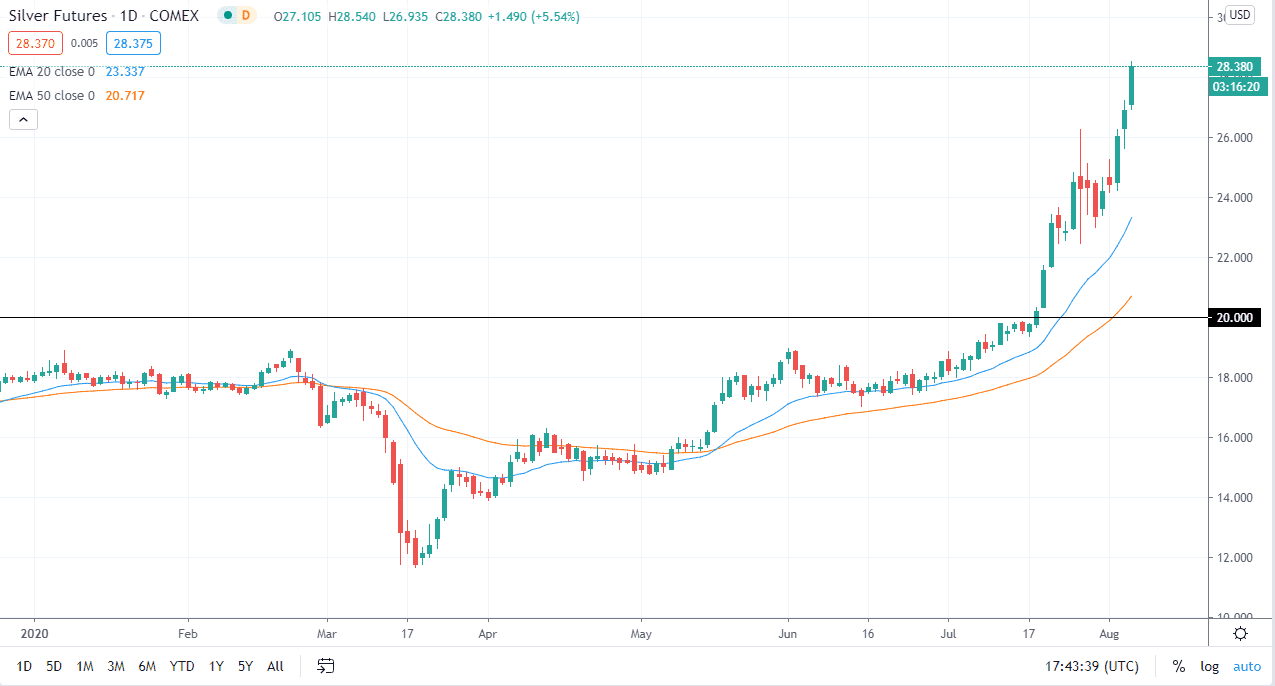

The silver markets have rallied significantly during the trading session on Thursday again, as we get set to look towards the Non-Farm Payroll numbers. Ultimately, this is a market that I think will continue to see a lot of bullish pressure over the longer term, but we are getting a bit overdone to say the least. Furthermore, the jobs number of course will have a major influence on what happens with the US dollar, which of course has a major influence on what happens with precious metals. As the US dollar continues to deteriorate, then commodities tend to rally, especially precious metals.

Silver tends to be much more volatile than gold, so it is not a huge surprise to see that it may be just a bit more parabolic then it is yellow cousin. However, it also has two pay attention to gravity as well, which has been thrown out the window from everything I can see. All that being said, I believe that the silver markets will go to much higher levels, perhaps towards the $30 level. However, I think at this point you need to look for a pullback if you are hoping to get involved. If you are already long of the silver market, then you have obviously made pretty decent money and would probably be looking to move your stop losses up.

Underneath, I see the $26 level as massive support, as it was previous resistance. Underneath there, the $24 level will offer plenty of support, just as the 20 day EMA which is just below there well. In other words, if we break down, and I am not going to lie here - I hope it does, I am more than willing to buy silver “on the cheap.” That is the only play you have because the more parabolic this market goes, the less stable it will be by the time it is all said and done. If that is going to be the case, you can probably expect some type of massive and sharp pullback. That massive and sharp pullback will shake out a lot of the “weak hands”, which should give you an opportunity to make some money as value comes back into the markets. I have no interest in shorting, and I think that given enough time we will find plenty of value hunters out there to drive this higher.