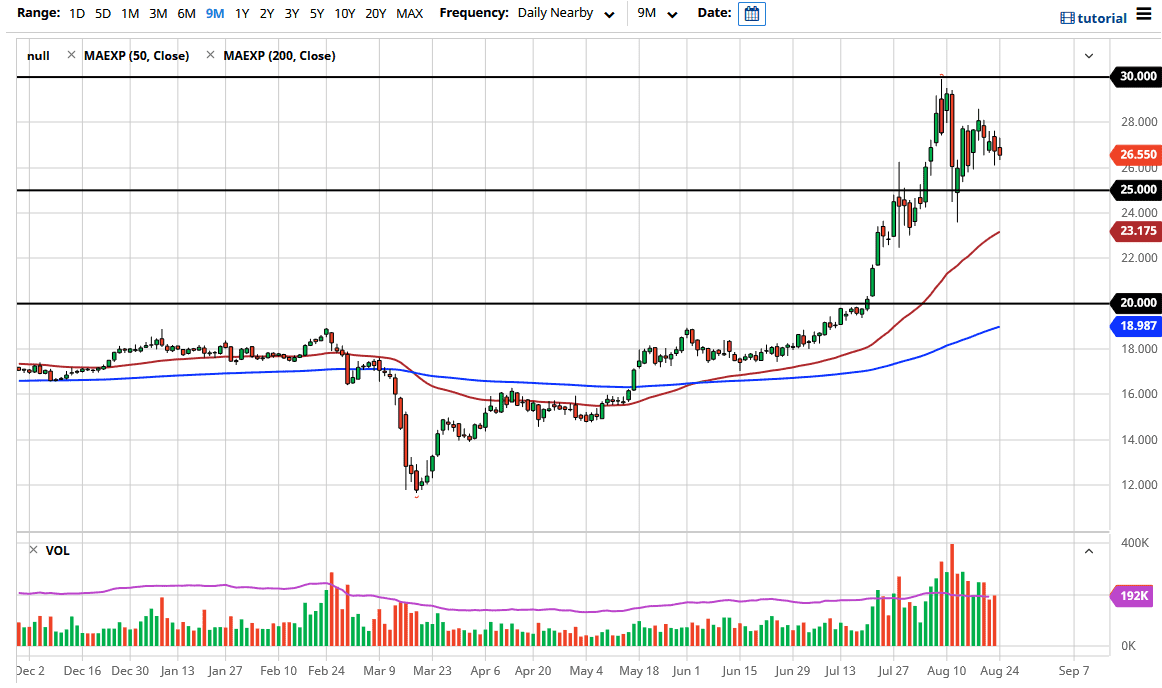

The silver markets initially tried to rally during the trading session on Monday but gave back the gains in order to show a less than desirable candlestick. That being said though, the market is likely to continue to reach a little bit lower before we find support, possibly somewhere in the neighborhood of the $26 level. That area extends down to the $25 level, so it is very likely that there will be a certain amount of interest in this market. After all, the $25 level is a large, round, psychologically important number, and therefore it is worth paying attention to. Furthermore, if we break down below the $25 level, then the $24 level also has shown itself to be supportive. In other words, we are sitting on a massive support region.

Just below there, the 50 day EMA is coming into the picture and it makes quite a bit of sense that it could also offer support. That being said, the market is likely to find buyers eventually, but it is worth noting that the US dollar is a bit overextended to the downside, and therefore a bit of a correction and all precious metals may be coming. That opportunity means that we could be looking to take advantage of cheap silver as it occurs, and I have no interest in trying to short this market.

I do believe that we will eventually go higher, so again, I will be a seller, but I will be looking to pick up “cheap silver.” Even if we were to break down a bit from here, it is likely that the market then will find a bit of a hard “floor” in the neighborhood of $20. Obviously, you do not want to hang onto silver all the way down there, but at that point I would back up the truck and start piling is much silver into my account as I can get. Not only is that the scene of a major breakout, but it is also a large, round, psychologically significant figure, and an area where we have the 200 day EMA approaching at the same time. Because of this, I do think it is only a matter of time before buyers would show up then and go looking towards the $25 level, followed by the $30 level. That being said, I do not think we drop that far and therefore I am looking for a buying opportunity closer to the $25 handle to turn around and reach towards $28 again. The silver market simply cannot be sold at this point, and therefore one needs to be patient.