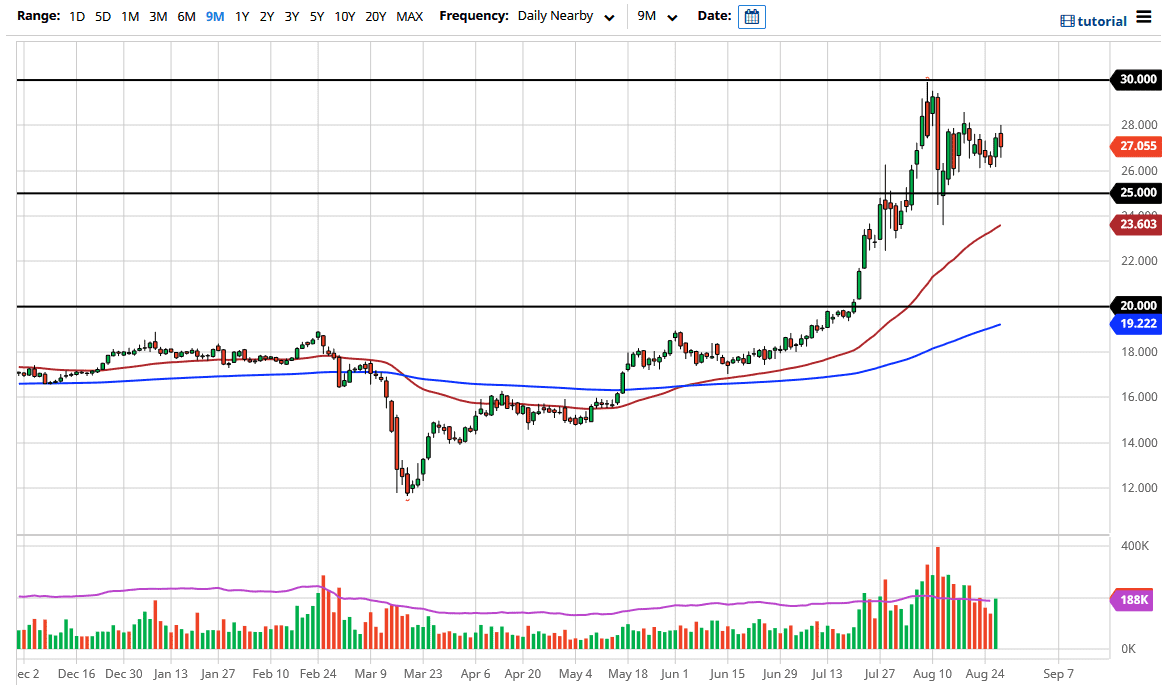

The silver markets initially rally during the trading session on Thursday only to turn around and fall rather drastically. Part of this may have been due to the statement and press conference by Jerome Powell being a little vague, and therefore the rally that had been forming over the last 48 hours may have been in anticipation of some type of extension of quantitative easing, or something else that Jerome Powell may have said. As he did not make any major shifts and policy for the immediate term, the US dollar recovered, thereby driving precious metals lower.

Looking at the candlestick, it shows that we do have a certain amount of support underneath, especially near the $26.50 level. The $28 level of course has offered resistance again, which was the previous level of resistance. We have bounced a bit off of the bottom, so that is somewhat positive, but I do not anticipate that this market is going to simply take off. I think that buying on the dips continues to be the best way to go going forward, as we clearly have a lot of interest underneath. After all, the US dollar is going to continue to be beaten on a bit, and I think that will continue to drive precious metals in both directions, as they tend to move in the opposite direction of the greenback.

To the downside I believe that the $26 level should offer plenty of support, extending down to the $25 level. At this point, we even have support at the $24 level because we have seen a bounce from there and of course the 50 day EMA is coming into that area. Keep in mind that silver tends to be extraordinarily volatile, so you must be cautious about your position size. With that in mind, you need to scale into a long position slowly and not risk far too much right away. This is going to be about building up a position for a longer-term move, as we will struggle at the $28 level but eventually go looking towards the $30 level, all things being equal. If we break above the $30 level, then it is likely that we can go much higher over the longer term. I currently have no interest in shorting metals.