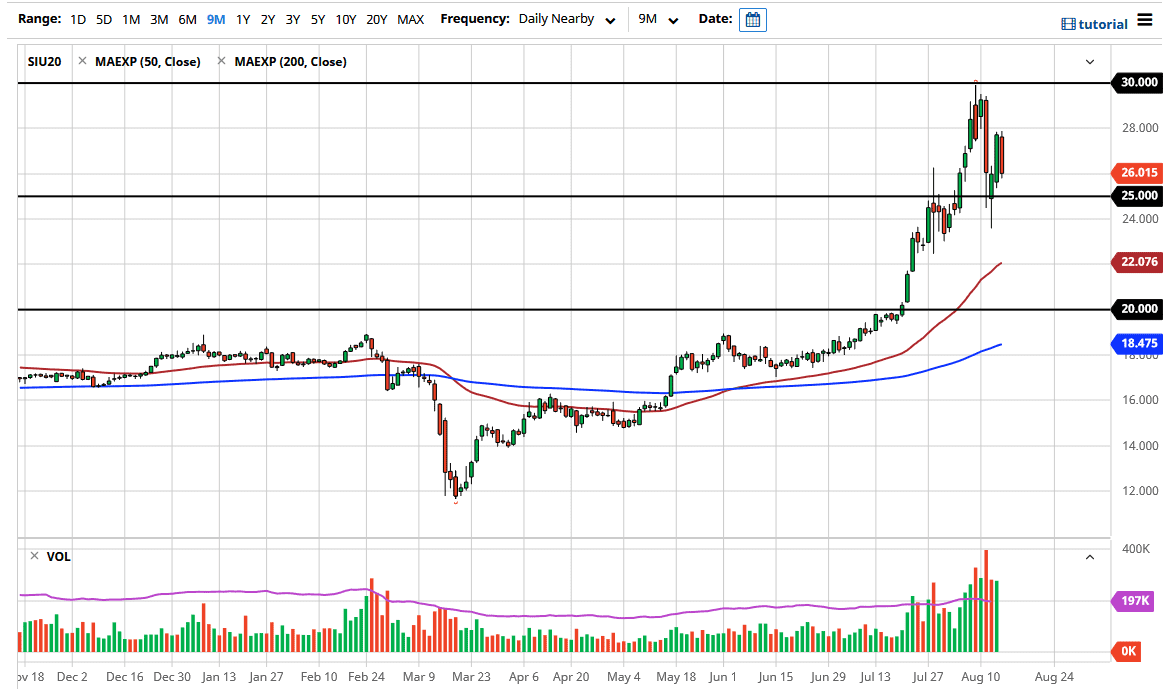

Silver markets have fallen a bit during the trading session on Friday, as we have seen a bit of profit-taking, or perhaps just simple consolidation. After all, the market has been very volatile during the week so it should not be overly surprising that we continue to see selling spats as well. We have dropped towards the $26 level before bouncing a bit towards the end of the day but what I am looking at is the overall trend.

We are clearly in an uptrend even though things have been rather brutal during the week. The fact that we formed a hammer during the trading session on Wednesday and then rallied rather drastically is a good sign because it shows a continuation of the overall buying pressure. The $25 level has made itself known, and now it looks like we could have a nice buying opportunity. As long as we can stay above the candlestick from Wednesday, I believe that this market is still very healthy, and we will eventually find enough buyers to push silver towards the $30 level again. I also believe that we could very well break above there, but a lot of what you are going to see will come down to what the US dollar is doing.

The more selling that we see in the US dollar, the more likely we are to see strength in silver, and other precious metals for that matter. Looking at this chart, I believe that it is only a matter of time before buyers come back in, and part of what we may see on Friday is simple profit-taking after the bounce as we go into the weekend. After all, it is difficult to stare at that Tuesday candlestick that was so brutal and will have wiped out a lot of retail traders that got far too over-levered, which is quite often the way parabolic markets end. Nonetheless, but does not mean that the overall trend has ended, just that a lot of the “weak hands” will have been flushed out. My email box has been filled with people asking me questions about silver, which tells me that it is probably not the best time to be buying. You want to see a lot of that retail interest die off before the market can continue to go higher. After all, they have a lot less in the way of risk tolerance than institutions do. I still like buying dips though.