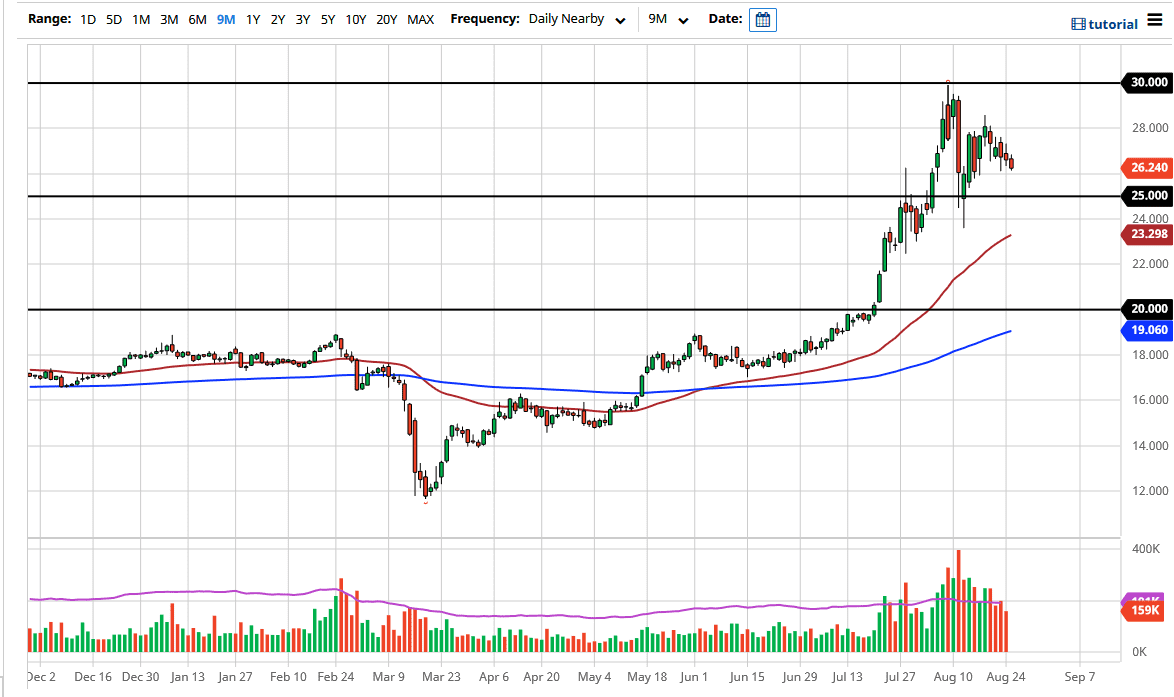

Silver markets have pulled back just a bit during the trading session on Tuesday as we continue to test the $26 level for support. This is a market that had been a bit ahead of itself, so it should not be a huge surprise that we have seen the market grind a little bit lower. After all, markets cannot go in the same direction forever, but one thing is for sure, the central bank attitude has not adjusted or changed recently that would make the US dollar suddenly strengthen. If that is going to continue to be the case, then it is only a matter of time before buyers jump back in.

Looking at the $25 level underneath, I anticipate that there should be a significant amount of support in that general vicinity because it is a large, round, psychologically significant figure and it is an area where the buyers returned after a particularly brutal couple of days. The question now is not so much as to whether or not we can get down there, but whether or not we will react to it when we get there. I will be looking for some type of supportive candlestick or bounce to get involved, and at that point in time, I am more than likely to look towards the $28 level. I also recognize that the $25 level extends down to the $24 level for support, not only due to the hammer that had formed there but the fact that the 50 day EMA is sitting in the same general vicinity.

To the upside, if we can break above the $28 level, I think that silver goes looking towards the $30 level given enough time. That is an area that will be difficult to break above but one thing that I know is that the few times that silver has broken above the $30 level, it seems to be attracted to $50, so it could be the beginning of a major move higher. Regardless, this is a market that got far ahead of itself, so it needs to work off some of this excess momentum in order to be a more sustainable uptrend. The same thing is seen in various currency pairs versus the US dollar, and I think that correlation continues. In other words, the EUR/USD, GBP/USD, and AUD/USD pair all should move right along with silver given enough time.