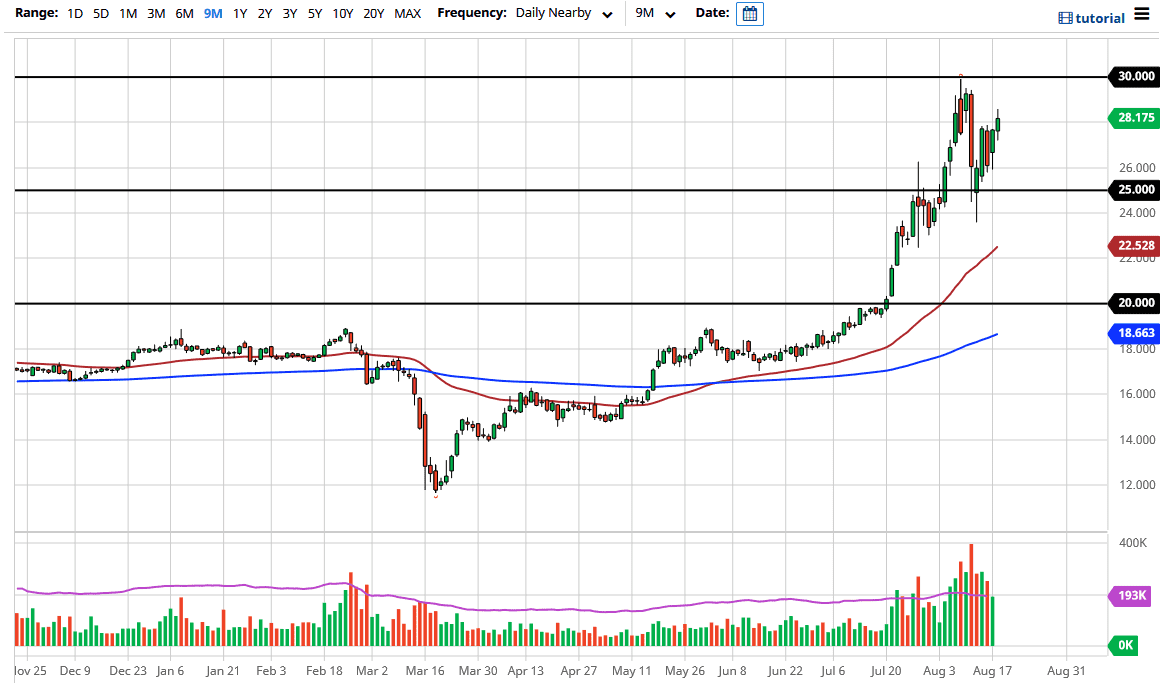

Silver markets initially pulled back a bit during the trading session on Tuesday but then found enough buyers to turn around and break above the $28 level. By doing so, it shows that we have an extreme amount of bullish pressure still, and the fact that we have broken above there tells me that we are more than likely to go looking towards the $30 level given enough time. I do like the idea of buying short-term pullbacks in-store because the Federal Reserve continues to flood the market with US dollars, therefore it makes a lot of sense that hard assets such as silver continue to go higher. Ultimately, I think that we not only reach towards $30, but perhaps break above there and go looking towards the $50 level over the longer term. This is a level that the market seems to be attracted to on these massive breakdowns, so I think it is only a matter of time before we try that same move.

Underneath, I think there should be plenty of buyers near the $25 level, as it was the scene of a major hammer, and it is a large, round, psychologically significant figure. I have no interest in trying to fight the uptrend, and even though we may get the occasional pullback, you need to look at that as significant value. After all, you want to buy things when they are “on-sale”, and therefore look at pullbacks as the same here. After all, you do not jump in and start buying a television if it is extraordinarily expensive. The same thing applies to financial markets as well, although for some reason traders fail to recognize that.

The breaking of the highs of the session on Tuesday would be a very bullish sign, but I hope we pull back in order to show signs of value. The $26 level is the beginning of support all the way down to the $25 level. A breakdown below that level opens up the possibility of a move down to the 50 day EMA, currently sitting at the $22.52 level. Either way, I have no interest whatsoever in trying to short silver or any other metal for that matter, as the US dollar continues to fall overall. With the Federal Reserve liquidity measures, commodities are entering a large super cycle.