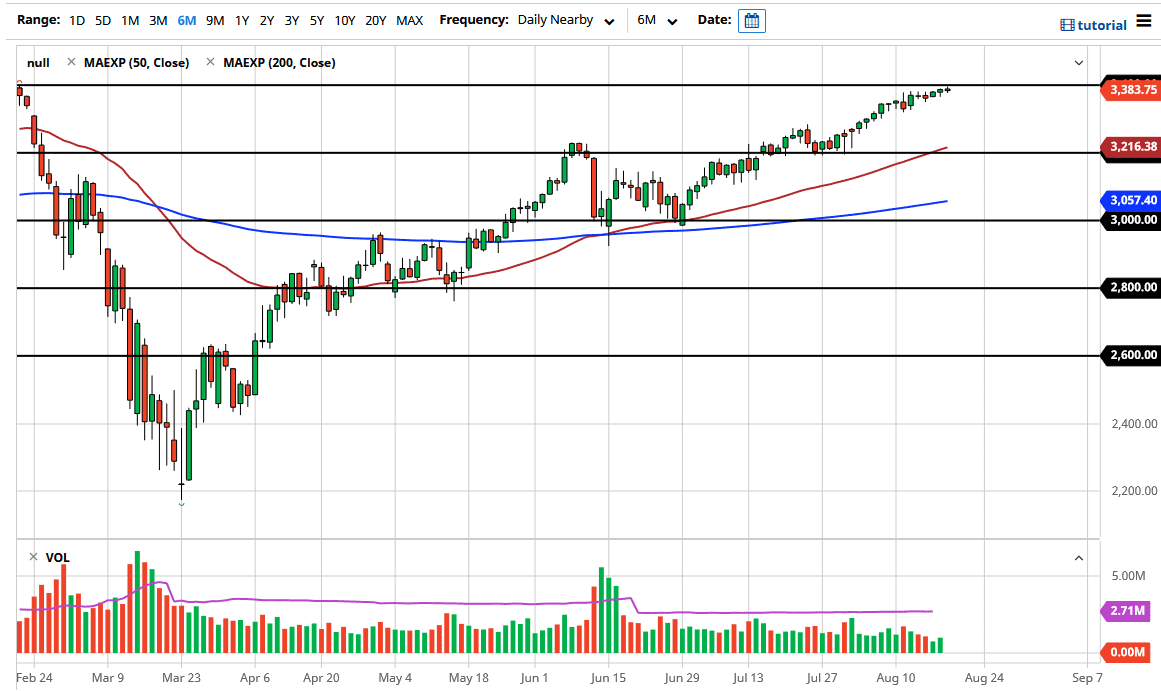

The S&P 500 has gone back and forth during the trading session on Wednesday as we are essentially killing time at high levels. Ultimately, this is a market that I think will eventually break out, mainly because of Federal Reserve liquidity measures if nothing else. Beyond that, a lot of traders simply want to see it happen, so it becomes a little bit of a self-fulfilling prophecy at times. The 3400 level in the E-mini S&P 500 contract seems to be a bit of a brick wall but given enough time we clearly will make a serious push towards that level and perhaps even as high as 3500 if we can get some type of break out.

Underneath, there is a massive amount of support, especially near the 3200 level as it is the scene of previous support and of course the scene of the 50 day EMA. The 3200 level is also a large, round, psychologically significant figure so it does make sense that we would have a certain amount of buying pressure in that area as well. Ultimately, I would look at that as the short term “floor” in the market. Having said all of that, I also believe that the 3300 level should offer a certain amount of support as well. In other words, I do not really have a scenario in which I am willing to short this market, at least not quite yet.

The markets have recently gotten through the earnings season, and it is quite common to see a short-term pullback as you reach an all-time high. This is worth noting that in the cash market we already have. With this, the market is likely to see a little bit of volatility but again I believe that picking up the market on dips will continue to work out, due to the fact that it offers perceived “value”. I do not have any scenario in which I am a seller here anytime soon, as the Federal Reserve is going to make sure that the markets go higher given enough time. At this point, it is a simple matter of whether you are long, or if you are on the sidelines waiting for a better price to start buying. Furthermore, this is vacation season so there may be a serious lack of interest by a lot of bigger traders.